Prada - Leading luxury brand available at a discount

Efforts to optimise store productivity and growth of Miu Miu brand should lead to higher profits over time

Prada S.p.A. (Prada) is a high-end Italian fashion label specializing in luxury goods for both men and women, including leather handbags, travel accessories, shoes, ready-to-wear, perfumes, and other accessories. The company was initially founded in 1913 by Mario Prada as Fratelli Prada (Prada Brothers). Prada trades on the Hong Kong stock exchange under the symbol 1913.HK and has a market cap of $163 billion HKD or 19 billion EUR.

Company history

Mario Prada established the company in Milan, Italy and it originally functioned as a leather-goods shop. Interestingly, Mario did not believe in women participating in business, but it was his daughter-in-law, Miuccia Prada, who played a significant role in turning the business into the celebrated name Prada is today.

Prada made a breakthrough with its first womenswear collection in 1988, under Miuccia Prada's lead, distancing itself from other brands with its drop-dead sophistication and straying from the era's flamboyant tendencies.

One of Prada's most iconic products is its black, hard-to-copy nylon bag which first debuted in 1984. Equally, the release of their first menswear line in 1993 further established Prada's hold on the fashion world.

In 1999, Prada joined forces with the De Rigo group to produce Prada eyewear. Around the same time, they also launched a cosmetic line, with their first luxury perfume being Prada Amber.

As a company, Prada has always had an intimate connection with various forms of art. Fondazione Prada, established in 1995, is an institution dedicated to contemporary art and culture. In a comparatively fresh venture, Prada has also moved into the food industry, opening Marchesi 1824's bakery in London.

Today, Prada is considered one of the most influential clothing designers in the fashion industry, renowned for its elegance and quality. Prada remains a well-known and sought-after brand. Its luxury goods are often seen as status symbols, with various celebrities and fashion influencers endorsing them.

Miuccia Prada, Mario’s granddaughter and her husband, Patrizio Bertelli, have been credited for transforming the family-owned business into a global luxury giant earning billions in revenue. The group also owns other brands such as Miu Miu, Marchesi, Car Shoe or Church’s or Luna Rossa. However the Prada brand along with Miu Miu represent 98% of sales.

Business overview

Prada's manufacturing process is deeply rooted in principles of quality, craftsmanship, and exclusivity:

Local production: The company owns 26 production facilities (23 in Italy, 1 in the United Kingdom, 1 in France and 1 in Romania). As a significant portion of Prada's products are made in Italy, it reflecs Prada’s commitment to quality and traditional Italian craftsmanship.

Quality Materials: The design process starts with sourcing high-quality raw materials. Prada uses a wide array of fabrics and materials, including leather, nylon, cotton, and silk, which are subject to rigorous quality control.

Workers’ Expertise: The expertise of Prada’s artisans is a crucial aspect of its manufacturing process. The products are often hand-crafted by skilled artisans who pay great attention to detail. According to the 2022 Annual Report, most of the production employees have been working for the Prada Group for an average of 20 years.

Design Process: The design team at Prada is always looking forward, creating innovative and trendsetting designs. Designs are directly overseen by Miuccia Prada with Co-Creative director Raf Simons.

Dedication to Craftsmanship: Despite using some machines to manufacture its products, Prada still relies heavily on the artisanal skills of individual workers, combining the best of both worlds to create products of exceptional quality.

Sustainability: Prada is focusing more on integrating sustainable and responsible practices in its manufacturing process in response to increasing awareness about the environmental impact of fashion.

As of 2023, Prada has hundreds of boutiques worldwide with an extensive retail network. The company has over the years closed down underperforming stores of other brands (Church’s and Car shoe) and slightly expanded the Prada footprint to 428 stores. Prada also closed 32 of Miu Miu stores since 2015. The vast majority of stores are company-owned, with only 25 franchised.

Brand value

The Prada brand is ranked among the top 10 most valuable fashion brands in the world and has secured the 86th place on Interbrand’s list of Best Global Brands. In addition, Prada and Miu Miu were ranked 1st and 2nd on the Lyst Index of hottest fashion brands of 2023. The brand has clearly stood the test of time and maintained its exclusivity and popularity for over a hundred years and its appeal is increasing worldwide.

Compared to other luxury brands, Prada’s retail productivity is lagging, with c. 14k EUR/square meter compared to 80-90k at Hermès and Louis Vuitton. There is significant room for improvement and Andrea Guerra, the newly appointed CEO has emphasised his focus on doubling the retail productivity in the company’s stores. So far, the plan seems to be working as the store count has seen little growth while revenues are hitting record highs. I believe the company can significantly expand its top-line as well as profits over the next few years.

Miu Miu Brand

Miu Miu is a high fashion women's clothing and accessory brand and a hidden gem of the Prada group. The brand was launched in 1993 by Miuccia Prada and is named after her family nickname.

Miu Miu was conceived as a more affordable and accessible line than Prada's mainline collection, targeting a younger demographic with its attention to detail, use of vibrant colors, and emphasis on prints and quirky, vintage-inspired styling. Despite its initial goal to reach a wider audience with more affordable options, Miu Miu quickly rose in prestige, becoming a high-end label akin to Prada itself.

The brand gained attention early on by bucking high-fashion trends. It was lauded for its lack of pretentiousness and apppeal to the "anti-fashion" youth movement of the time. Miuccia Prada wished to foster this "bad taste" aesthetic, capitalizing on a mix-and-match, "ugly chic" approach. This included everything from contrasting vintage, classic, and mundane everyday clothing with high-end fashion wear, incorporating an eclectic range of colors, fabrics, and patterns into designs. Miu Miu has a close association with Prada, with both brands' shows often sharing common influences and design elements.

Miu Miu's first independent store opened in 1997 in New York's SoHo district, with the brand quickly expanding to have its presence in the United Kingdom, France, Japan, China, and other prominent fashion cities worldwide.

In its advertising, Miu Miu has often enlisted high-profile actresses, including Hailee Steinfeld, Kirsten Dunst, Elle Fanning, and Dakota Fanning, further cementing its reputation as a youthful, contemporary label.

Today, Miu Miu stands as a notable player in the global fashion industry, with its clothing, footwear, handbags, and accessories available worldwide.

Management

The company is led by Miuccia Prada (74) and her husband Patrizio Bertelli (76), who together own 80% of the business. The remaining 20% is floated on the Hong Kong stock exchange. Both Miuccia and Patrizio serve as executive directors, while CEO is a newcomer Andrea Guerra, former chief executive of Luxottica and head of LVMH’s hospitality division. In addition, Miuccia is the Creative Co-Director along with designer Raf Simons.

Miuccia Prada remains the dominant force in the firm, with her intense work ethic and burning passion for design and fashion. New CEO Andrea Guerra has been at the helm only since January last year and it still remains to be seen if the transition will be smooth. However the results speak for themselves and the company is successfully growing its main brands worldwide.

Financial overview

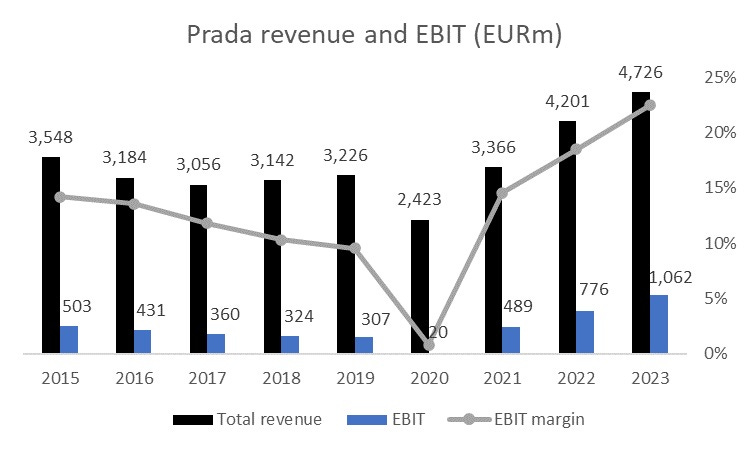

Revenue has hit a record high in 2023 on the back of strong growth of Miu Miu and double digit gains in their Prada brand retail sales. The COVID-19 pandemic significantly impacted the global luxury goods industry, including Prada. The company had to close stores, foot traffic worldwide fell and tourism revenue collapsed. Despite that, Prada maintained positive EBIT and kept reinvesting in growth during the pandemic. Despite having the lowest store count in at least a decade, Prada revenue has hit a record high and EBIT has doubled over the same period.

The strong growth in profitability is explained primarily by rising gross margins, which hit a high of 80% in 2023, up from 72% in 2015. Likewise, EBIT margins expanded from 14% to 22% over the same period. The company also earns royalty revenues from perfumes and other products, which represented 2.2% of sales in 2023.

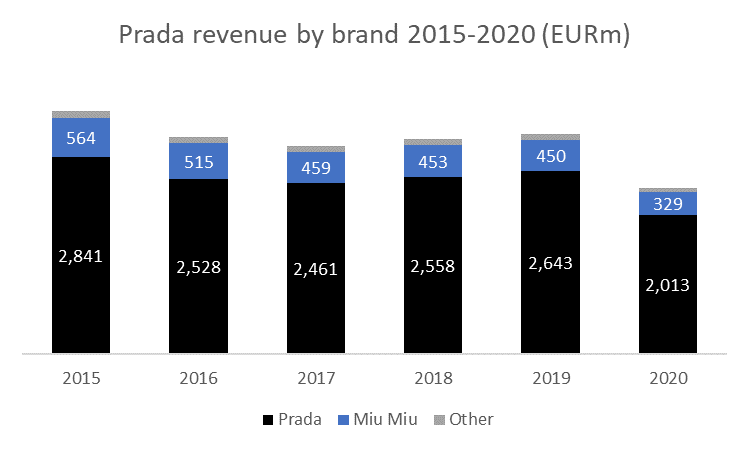

During mid 2010s, the brand appeared to be losing its relevance. The number of Miu Miu stores steadily declined and Prada revenue dropped to a Covid-19 low of 2 billion EUR in 2020.

Thanks to excellent execution, fashionable design and savvy marketing, revenues are growing at a rapid clip at both Prada and Miu Miu despite no significant changes in store count. Prada changed its reporting practice in 2021 and reports a brand mix for only net retail sales excluding wholesale revenue (c. 400m EUR), as a result I had to split the chart into two as they are not directly comparable.

It is pretty clear though that is firing on all cylinders, with sales Miu Miu sales rising 82% in Q4 alone. The brand’s popularity has soared over the past few years as many celebrities in the West and China started wearing its clothes. The fashion industry is notoriously unpredictable, but certain brands have maintained their value and appeal for decades and if Prada can sustain Miu Miu’s momentum, it could eventually grow to account for a much larger share of total revenue.

Asia Pacific remains the most significant region for Prada where net retail sales grew 17% despite a slowing Chinese economy. Sales in the Americas experienced a slight decline, where the luxury retail market is experiencing challenges as reported by several retailers such as LVMH or Richemont. Once the market there rebounds, it should carry Prada’s revenues to higher levels in the next few years.

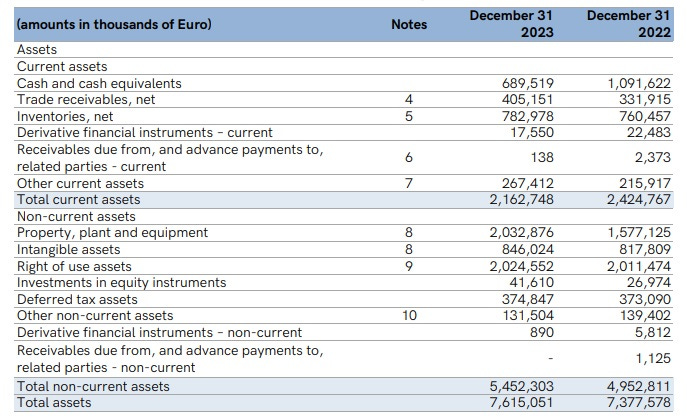

Prada had 7.6 billion EUR in assets at the end of 2023, with the majority being plant and equipment, right of use assets which are tied to their leased stores and intangible assets. The company has bought the New York Fifth Avenue store for $425 million, which partially explains the drop in cash and large increase in plant & equipment line. Fifth Avenue is the world’s most expensive retail street which explains the high price tag.

Lease liabilities total 2.1 billion EUR, with bank debt and and financial payables of 486 million EUR. The total net debt, taking into account cash of almost 700 million EUR is therefore c. 1.9 billion EUR, which is not excessive given that EBIT has surpassed the 1 billion level in 2023.

Luxury market overview

The luxury fashion market is a section within the overall global fashion industry dedicated to luxury goods like high-end clothing, accessories, handbags, footwear, and more. It's characterized by products that are excellent in quality, craftsmanship, and reputation often attributed to well-established brands.

Several brands dominate the luxury fashion market, most of them originating from fashion capitals like Paris, Milan, and New York. Famous names include Chanel, Gucci, Louis Vuitton, Prada, Burberry, Versace, and more.

This market segment caters to affluent customers who value exclusivity, premium quality, and brand prestige over price. Designers and brands often release limited editions or collections to maintain this exclusivity and scarcity.

The rise of online media and e-commerce has also affected the luxury fashion market profoundly. Social media has become a vast platform for marketing and influencing consumer trends. Simultaneously, online sales channels are expanding, making luxury goods more accessible to people worldwide.

In terms of market trends, sustainable and ethical practices in production have become increasingly important. Many luxury brands are now focusing on using environmentally friendly materials and methods, and emphasizing fair trade and ethical labor practices.

This is in stark contrast to fast fashion companies, which focus on offering trendy clothes as quickly and cheaply as possible, which often leads to items being made with less-quality materials and craftsmanship.

Fast fashion brands prioritize getting current fashion trends into stores quickly, often within weeks. This speed comes from a highly efficient supply chain that can design, manufacture, and deliver new styles in a short period. Luxury fashion, in contrast, typically operates on seasonal cycles, with new collections released for spring/summer and autumn/winter. The design and production process for luxury items can take months because of the attention to detail involved in creating high-quality items.

Luxury brands control their sales channels tightly, selling through their own branded stores and selected high-end department stores. Fast fashion brands often have a wider distribution network, including many high street stores and online platforms.

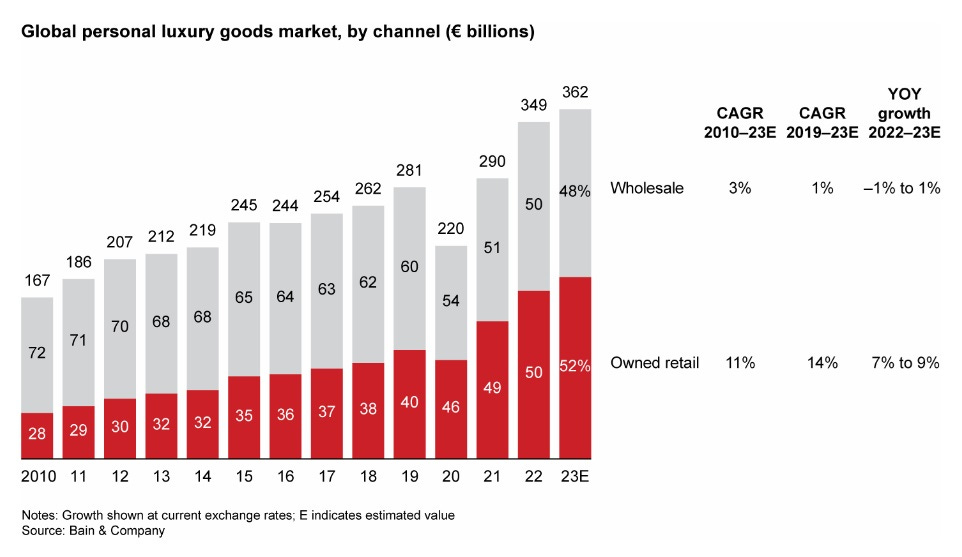

According to Bain & Company, the global personal luxury goods market has reached 362 billion EUR in 2023 and is expected to grow low- to mid-single-digits this year, with a CAGR of 5-7% up to 2030. In addition, Bain expects the growth to be driven in large part by Chinese consumers, who are yet to regain their pre-Covid status as the dominant nationality for luxury goods.

Apart from Prada, key players in the luxury fashion market are:

LVMH (Louis Vuitton Moët Hennessy): This French multinational corporation and conglomerate specializes in luxury goods, owning various renowned brands like Louis Vuitton, Christian Dior, Fendi, Givenchy, Marc Jacobs, and Bulgari, to name a few.

Kering: Another French multinational corporation, Kering is known for owning luxury brands such as Gucci, Yves Saint Laurent, Bottega Veneta, Alexander McQueen, and Balenciaga.

Richemont: Based in Switzerland, Richemont possesses several prestigious brands in the field of luxury goods, including Cartier, Van Cleef & Arpels, and Montblanc. While it's recognized more for its jewelry and watch brands, it also owns fashion brands like Chloe and Alaïa.

Estée Lauder Companies: While primarily known for beauty products, this American multinational manufacturer and marketer also owns high-end fashion brand, Tom Ford.

Capri Holdings (formerly Michael Kors Holdings): This fashion holding company owns Michael Kors, Versace, and Jimmy Choo.

Hermès: French luxury design house established on June 15th 1837. It specializes in leather goods, lifestyle accessories, home furnishings, perfumery, jewelry, watches and ready-to-wear.

Ralph Lauren Corporation: This American corporation produces mid-range to luxury fashion products, and segments such as Polo Ralph Lauren, Ralph Lauren Collection, Lauren Ralph Lauren, Double RL, Ralph Lauren Childrenswear, and Club Monaco are leading names in luxury fashion.

Despite a softer market in US and macroeconomic challenges in China, the luxury fashion market is poised for growth in the coming years, driven by the increasing purchasing power of consumers, particularly in emerging economies, and the evolving digital landscape making these products more accessible.

Prada has a similar valuation to Richemont, despite growing much faster. Prada’s free cash flow was negatively impacted by the one-time purchase of the New York Fifth Avenue building, I expect the free cash flow margins to hit at least 15% next year. Hermès is an outlier, way more profitable than any other competitor and growing very fast. Prada actually grew 17% in the last quarter while LVMH grew just 5.5%. As Prada’s fundamentals improve over the next few years, it should be awarded a higher multiple.

Valuation

I have done a simple DCF calculation for Prada, estimating its future revenues and cash flows for the next 10 years. I have used a 15% revenue growth rate for the near future, declining over time to 7%. I also assume they will hit 26% EBIT margins after 4 years (similar to LVMH), due to their efforts to optimise stores and increase their productivity. Retail is a fixed-cost business and additional revenues from stores increase operating leverage significantly.

I also assume they will expand their leases as they grow in size over time. Tax rate is kept at 32%, an average of the least 3 years. Using these calculations, I arrive at an equity value of 25 billion EUR, above the current market cap of 19 billion, implying an upside of c.30%.

Key risks

Economic downturns: Luxury fashion items are usually the first to be affected in an economic downturn as they are considered non-essential items. Consumers might prioritize their spending towards necessities and downgrade from luxury items to cheaper alternatives.

Competition: The luxury fashion market is incredibly competitive with brands constantly having to innovate and deliver superior quality products and experiences to stay ahead in the market.

Counterfeit Products: The high value of luxury fashion products makes them prime targets for counterfeiters. Counterfeit products can harm the reputation of the brand, reduce sales and profits.

Changing Consumer Trends: Fashion trends can change quickly, and brands that fail to keep up with these changes risk losing their customers to more trendy alternatives.

Summary

Prada is a brand that has stayed relevant for more than 100 years and is growing steadily thanks to its recent efforts to improve productivity. The shares are valued on par with its peers Estee Lauder and Richemont, despite showing higher growth and improving profitability. Based on my estimates, the company could be potentially worth more than 25 billion EUR (vs current market cap of 19 billion EUR). I believe investors can buy one of leading luxury brands in the world for a discounted price.