AirSculpt Technologies (AIRS) IPO analysis: Body contouring procedures that seem to work

Key takeaways from the recent IPO

S-1 Highlights1:

$63m in revenue in 2020 (52% yoy growth)

Net income improved from a loss of $2.2m to a gain of $7.6m

Q3 unaudited revenue2 (ending Sep 2021) of $34.6m (up 94% yoy)

Q3 pro forma net income of $6.2m (up 158% yoy)

Revenue per procedure up 21% to $12,600

Number of procedures up 60% to 2,743 in Q3 2021 vs Q3 2020

AIRS went public on October 29th 2021 at a price of $12.84, reaching as high as $18 on its first day3. The company sold 7 million shares for proceeds of $77 million.

The shares currently trade for $11.30, which is 37% below the highs achieved during its IPO day, but roughly in-line with its IPO price. The market cap is $628m according to Yahoo Finance.4

Business overview

AirSculpt Technologies (AIRS) was founded in 2012, and the company provides custom body contouring using the proprietary AirSculpt method that removes unwanted fat in a minimally invasive procedure. It requires no scalpel and no needle or stitches. The patient is awake during the procedure with minimal local anesthesia. Patients are usually discharged after the procedure and resume their normal life the next day.

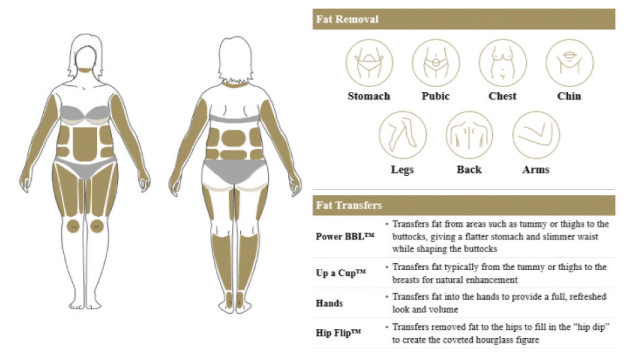

In addition, they also offer fat transfer procedures that use the patient’s own fat cells to enhance the breasts, buttocks, hips or other areas and do not require silicone or foreign materials to be implanted. This is quite an innovative method of enlarging certain body parts, which might be in strong demand in today’s Instagram world.

AIRS has its own Youtube channel, where they post procedures as they are performed.5 The company has done 5,800 procedures in 2020 in 16 centers and 13 states. In most cases they subcontract surgeons (usually for 2-3 years) to perform the procedures themselves. All procedures are private pay, that is the patient pays from his/her own pocket meaning there is no reimbursement risk from reinsurance companies.

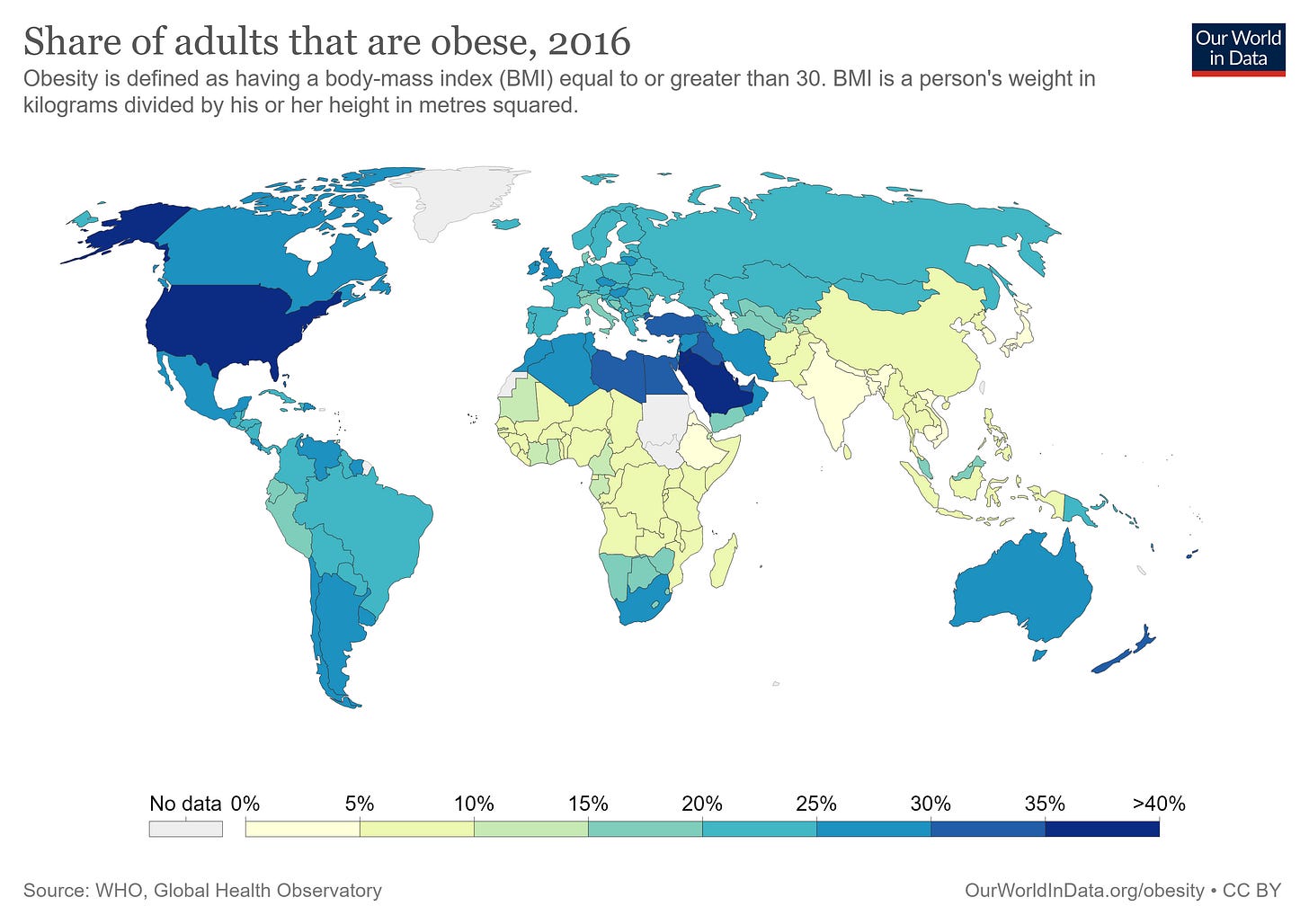

There are several trends that are driving the number of fat reduction procedures. The number of obese people in the US is over 40% of the population6, which is an extreme number compared to other countries in the world. As of 2016, 13% of adults older than 18 were obese globally7.

Social media has exacerbated the anxiety of many people, who desperately want to look like their favorite models or influencers. On the other hand, many social media celebrities are sharing the results of their procedures online, which reduced the stigma of undergoing aesthetic treatment. That’s why the market is expected to grow high single digits until at least 2026.

AirSculpt advantages

Most procedures use surgical intervention to reduce fat, or a combination of medication and cooling of skin to produce fat loss.

AirSculpt is similar to other liposuction lasers. A small opening (usually around 2mm) is created in the skin to infuse air into the fat (provides a numbing effect or local anesthesia). This is where the company gets its name from. Occasionally, a patient might require some additional medication to be administered.

Following the infusion of air, a laser is then inserted, heating the skin and melting fat. A small cannula (moving 1,000 times per minute) is used to remove the fat and tighten skin8.

A laser is then inserted, creating heat to melt the fat. The last step is removing the fat through a small tube (cannula). The process as a whole is similar to certain laser lipo procedures that typically require general anesthesia.

According to the founder, this results in less downtime, faster healing and smoother results. The procedure doesn’t require stitiching, but leaves only a small hole.

The difference between AriSculpt and general lipsuction is that in the latter case, a hollow suction tube is inserted through an incision to remove fat from under the skin with a scraping motion. The patient is usually under general anesthesia and the procedure is more painful and requires days or weeks to recover. There are also stitches to fix the opening where the tube was inserted.

The company owns 2 patents and has 3 more patent applications pending. They relate to the process of sculpting and not to the technology that is used.

AirSculpt Technologies offers fat transfer as well under different procedures:

The operation centers are usually located in high-end retail areas, such as Rodeo Drive in LA and Fifth Avenue in New York. This helps bring valuable customers, but also means that rental costs must be extremely high. The centers usually have 1-2 operating rooms and provide 36 procedures per week. The average revenue per procedure is $10,600. The company claims that centers that have been open since 2019 achieved profitability within 3 months of opening.

The company subcontracts full-time and part-time surgeons and offers them the option to market their own practices to sculpting patients. Which means a doctor can do part-time surgeries for AIRS, and then provide face lifts or other non-competing procedures at his private clinic. Surgeons can therefore increase their income, reputation and number of patients they serve.

Financials

The company is growing very rapidly, and the revenues for the first half of 2021 are almost at the level of full year 2020. Not only that, but they are highly profitable, with an unaudited net margin of 20%+. The company generated almost $24 million in operating cash flow in H1 2021, or 39% of revenue. These are very good numbers and they basically do not need external financing at this point and can fund the expansion of clinics themselves.

Patients are billed in advance for procedures, and those that haven’t been performed yet are recorded in deferred revenue on the balance sheet.

AirSculpt uses a structure of Professional Associations (PA), which are separate legal entities owned by individual surgeons, who are responsible for the delivery of medical procedures. Revenue is then shared with them according to individual contracts. This reduces the risk of litigation as well, as the surgeons and the PAs are responsible for the medical side of the procedure.

The company had $82m in debt and only $16m in cash at the end of June 2021. Which is kind of strange given the high levels of operating cash flow they generate. Perhaps it’s due to the private equity ownership of the clinic (utilize debt to pay dividends). These are still unaudited numbers according to their S-1 filing. Nevertheless, the company raised almost $80 million in its IPO, so they should have sufficient capital to either extinguish debt or finance the expansion of clinics.

The number of procedures, operating rooms and clinics has steadily risen over the past year and a half.

The company was negatively impacted by COVID-19 during the first half of March 2020 and during the second quarter of 2020, as a signifcant number of procedures was postponed.

Management

The company was founded by Dr. Aaron Rollins, who remains the CEO. Dr. Rollins went to medical school at the McGill University Faculty of Medicine in Montreal, Canada after completing his undergraduate studies at McGill University. He became famous as a cosmetic surgeon for Kim Kardashian and other celebrities9.10

Dr. Rollins always loved sculpting and later enrolled to Medical School, thanks to which he discovered plastic surgery.11

Ronald P. Zelhof is the COO of the firm and previously he served as SVP of Operations for Surgery Partners (publicly-listed operator of surgery centers) where he oversaw all Florida Ambulatory Surgery Center operations for over a decade. He also spent over 20 years with Healthsouth in various positions.

Major Shareholders

The largest shareholder is Vesey Street Capital Partners (healthcare specialized Private equity firm), which holds more than 52% after the IPO. The founder Dr. Aaron Rollins still holds a 24% stake, which means he has skin in the game and is incentivized to grow the business over the long run.

Reviews

The company has very good reviews on RealSelf (aesthetic procedures review site) with an 88% approval rating based on 111 reviews12. There are many other reviews posted online13 or on Youtube which are generally positive. Yelp reviews rate the company as 4.5/5 stars, which is pretty good.14 The technology and process seem to be working.

Competition

The fat reduction and aesthetic surgery markets are intensely competitive. Alternative offerings include liposuction, abdominoplasty (tummy tuck) and gastric bypass surgery, and non-surgical procedures that use cooling, injected medication or heat to reduce fat cells.

There are plenty of solutions a patient can choose from, many of them much cheaper than AirSculpt. InMode (INMD), a publicly-listed medical device and treatment provider is one of the major competitors of AIRS. InMode sells devices that use radiofrequency energy to heat the skin and burn fat. They have a starting cost of $1,500, way below AirSculpt’s.

Market size

Body fat reduction procedures include liposuction and abdominoplasty as well as non-surgical procedures such as cryolipolysis, ultrasound, laser lipolysis and others. There are many ways how patients can alter their body or reduce their fat.

The market for fat reduction procedures in United States was worth $2.6 billion in 2020, growing at approximately a 6.5% compound annual growth rate, expected to increase to a CAGR of 9.8% until 2026. The non-surgical fat reduction market is much smaller at just $434m, but growing at 13.5% p.a., expected grow by 16.5% CAGR by 2026, ultimately reaching at least $900 million.

The company believes, they can expand internationally to other affluent metropolitan centers.

The overall size of the market might be a bit misleading, as their solutions are reserved for the affluent clientele, as the majority of the population can’t afford a $12,000 fat reduction surgery. So I would say the addressable market is smaller than the numbers presented above as that includes both high end and low priced solutions. In fact, 43% of their revenue in 2020 came from patients who secured external financing for the procedure.

Risks

The company relies on a single supplier (Euromi) for the manufacturing of its devices

The high price per procedure means that it’s reserved only for high net worth individuals and inaccessible to the general population.

The body contouring and fat reduction market is highly competitive, with dozens of offerings available from a myriad of companies. Given the low tech nature of the business and no patent protection of its devices, the competitive advantage of the business relies mostly on the strength of its brand.

Body contouring companies are always exposed to lawsuits and litigation from unsatisfied clients. This has happened with many companies in the past, but AirSculpt is partially shielded from this issue thanks to working through PAs.

Valuation

According to Yahoo Finance, the current market cap is $630 million, the debt is unknown at this point as the final numbers are unaudited and the company raised additional funds in the IPO.

If we just annualize their H12021 numbers, we are talking about $122m in revenue and $24m in net income, which would mean that the company spots a forward P/S ratio of 5.1x and forward P/E of 26x. This seems pretty cheap given their strong numbers.

Conclusion

AirSculpt is a profitable and growing business with a very strong brand. However, their competitive advantage seems to be weak, as it only relies on a certain process of laser lipo and removing fat. It will be a very attractive target for competition, given their significant profitability. As Jeff Bezos says: “Your margin is my opportunity”. Another issue is that if people actually exercised or went for a run after work, it would be a much healthier option that putting up thousands of dollars for fat reduction.

Nevertheless, the management has executed very well and shares seem cheap given their growth rate and potential for expansion. It’s worth watching the company in subsequent months, to see if they expand internationally or introduce new procedures and products.

https://investors.elitebodysculpture.com/static-files/1f463fb7-150b-46d7-9993-5508f0489ed4

The company provides only unaudited numbers for the September 2021 quarter. As a result the numbers are only pro forma.

https://www.marketwatch.com/story/airsculpt-shares-soar-in-debut-after-downsized-ipo-airs-271635522698

https://finance.yahoo.com/quote/AIRS?p=AIRS

https://www.youtube.com/channel/UCOOZESwMtbboXme9-qBV_rw.

https://www.cdc.gov/obesity/data/adult.html

https://ourworldindata.org/obesity

https://www.papercitymag.com/fashion/fat-be-gonethe-skinny-on-airsculpt-laser-lipo/

https://www.hollywoodreporter.com/lifestyle/style/airsculpting-is-hollywood-s-newest-body-shaping-treatment-1089434/

https://www.barstoolsports.com/blog/769793/kim-kardashians-alleged-original-butt-doctor-said-her-ass-is-like-letting-air-out-of-the-balloon-these-days

https://medium.com/authority-magazine/nothing-feels-better-than-doing-something-good-for-others-with-dr-aaron-rollins-2f39d1128898

https://www.realself.com/reviews/airsculpt

https://www.allure.com/story/airsculpt-before-and-after-photos

https://www.yelp.com/biz/elite-body-sculpture-beverly-hills-beverly-hills-2