Coinbase IPO deep dive: The journey to a $200 billion valuation

Coinbase is the most trusted name in the crypto economy and even a drop in cryptocurrency prices won't stop their advance

Coinbase (COIN) will go public next week on April 14th and it’s time to take a deep dive into their business model and potential future growth. I do not claim to be a cryptoexpert, but I have always been fascinated by the industry and a small part of my portfolio is in bitcoin. I really admire the business that Coinbase has built and decided to look closer at the company before they go public.

Coinbase probably needs no introduction. It’s the largest cryptocurrency trading platform in the world, with $223 billion in assets, more than half of that from institutions. Over $335 billion in trading volume was conducted on Coinbase during Q1 2021 alone

Q1 Highlights:

Revenue of $1.8 billion (up almost 10-fold)

Net income of $730 to $800 million (up more than 20-fold)

56 million verified users, 6.1 million out of that monthly transacting users (MTU)

The company expects MTU to range between 4 and 7 million for 2021, depending on the volatility of crypto prices

Verified users are those that have registered on the platform on confirmed their e-mail address, while transacting are those that bought, sold or converted a cryptocurrency.

The cornerstone of their platform (started in 2012) is trust and ease of use, which is also a reason why I chose them to open a crypto account. The number of verified users has grown very steadily each quarter from 23 million to 43 million (56 million in Q12021), despite huge volatility in crypto prices.

What’s striking is that 90% of their users joined Coinbase organically, without any marketing effort. Few companies can boast such a number, except maybe for Tesla or Amazon.

Unlike many other platforms that try to fly under the radar to avoid regulatory scrutiny, Coinbase was proactive from the start when it comes to regulations. They applied for licenses even before they were needed, built necessary security applications to guard user data and safety of their accounts and obtained a cybercrime insurance policy. I think this makes them a bit unique, as crypto currencies were initially also used to pay for illicit activites and the main players wanted to stay out of the limelight.

The CEO Brian Armstrong states in his letter in the S-1 filing, that the goal is to operate the company at a breakeven level for now, making a profit when crypto prices are high, and making a loss when they are low.

The company’s aim is to aid in the development of the cryptoeconomy, an efficient, fair and transparent way to transact online using cryptoassets: digital assets built through blockchain technology.

While there are many competing platforms such as Kraken, Bitstamp or IDEX, Coinbase has been steadily gaining market share despite these pressures. Assets held at Coinbase represented 11.1% of the crypto market capitalization at the end of December.

What products and services does Coinbase offer?

Coinbase mainly offers the primary financial account for retail traders for the cryptoeconomy – a safe, trusted, and easy-to-use platform to invest, store, spend, earn, and use crypto assets.

Trading

The company supports trading of 90 cryptoassets, integrated with more than 15 blockchain protocols and generates 96% of revenue from trading commissions. Coinbase also provides subscription services (126% yoy growth), however they represent a small part of revenue.

They also provide an institutional platform for hedge funds, money managers, and corporations, which allows them to access crypto markets through advanced trading and custody technology, built on top of a robust security infrastructure.

In addition, Coinbase acts as a platform for developers, merchants, and asset issuers,that enables them to build applications that leverage crypto protocols, actively participate in crypto networks, and securely accept cryptocurrencies as payment.

What is a blockchain protocol? When it comes to computers, a protocol is basically a set of rules or guidelines that govern the transfer of data between two or more electronic devices. This protocol helps in establishing how, in order for computers to exchange information, the information must be structured and how each party will send and receive it.

Some protocols that you might be familiar with are TCP/IP, HTTPS, and DNS.

Coinbase Visa card

n 2019, in partnership with Visa, the company launched the Coinbase Card, a debit card funded by a customer’s crypto asset balance on Coinbase. Everytime a user pays with the card, his or her cryptos are sold in the correspending amount to fund the purchase. Coinbase earns a volume-based transaction fee.

Transfer

Users can also send and receive crypto assets through Coinbase. This service is generally free.

Subscription and services

Coinbase derives revenue from custodial fees for their cold storage offering. They also earn revenues from “staking”, the transaction validation on a proof-of-stake blockchain, when one of their nodes successfully creates or validates a block.

They also offer services to crypto issuers (ICOs) in forms of videos or content they can distribute to users. Coinbase takes a cut of the gross amount raised through these offerings.

Money transfers

Coinbase also allows you to send money internationally to anyone with a Coinbase account for free and receive it basically instantly, which is a great function.4 The company is licensed in money transfers and virtual currency business in all U.S. states.

Coinbase wallet

The company initially started as a crypto wallet, which allowed users to store keys. They scrapped the solution and became an exchange, but later in 2018 introduced wallet services again.

Coinbase and Coinbase pro

Their first product was initially started to provide anyone a quick and easy access to crypto currencies. Later they expanded into Coinbase exchange (GDAX) which was later rebranded as Coinbase pro. The difference is that the pro version allows users to place stop and limit orders, as well as view charts and use other features.

Coinbase Fees

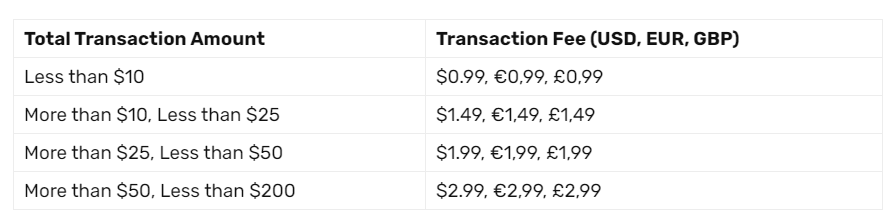

The fees depend on your location, payment method and other variables. Coinbase charges a fee of 0.5% (spread) of transaction amount1. The spread might be higher or lower than 0.5% depending on market volatility.

In addition to spreads, Coinbase charges a flat or variable fee, whichever is greater.

Source: https://help.coinbase.com/en/coinbase/trading-and-funding/pricing-and-fees/fees

The variable fees are usually 1.5%-4%, depending on your location and whether you funded the purchase through a bank account wire or debit card.

Conversions are charged differently, because you basically achieve a trade in only one transaction instead of two. So instead of selling Bitcoin and buying Ethereum (pay fees 2 times), you simply convert it to Ethereum. Coinbase charges 2% for crypto currency conversions.

Coinbase pro fees are different, as they depend on your monthly trading volume. They start at 0.5% of transaction value and decline gradually towards 0.05% at a volume of $500 million. I guess only the large whales get to that level, most of their clients probably pay the 0.5%.

The fee structure is pretty complicated and the fees seem way above what competitors charge.2 I guess the company can get away with these prices for now, as some users just want to own crypto assets and do not care that much about commissions paid.

Over time, their fees will tend to decline, as competition in the crypto industry intensifies. As stated in their S-1 filing: “Similar to other financial products, as the industry matures we anticipate fee pressure to emerge over time. Our strategy is to maintain our position as a trusted brand in the crypto space and develop new products to enhance our customer value proposition and offset the effects of any future fee pressure.”

Regulation and its impact

Blockchain technology and regulations are constantly evolving, but it’s likely that only large players will be able to keep up and stay in business. Regulation usually protects incumbents and it seems that Coinbase has become the incumbent in this case.

Here is one crazy statistic, the value of crypto assets grew from $500 million in 2012 to $782 billion by 2020, a CAGR of 150%! That number has actually climbed to almost $2 trillion since the start of the year.

Crypto regulation varies widely across countries. Some ban crypto currencies (Pakistan, Vietnam), others restrict financial institutions from allowing users to buy these currencies (China, Thailand, Iran).3 The majority of countries allow crypto currency trading, their regulation is focused mostly on warning against crypto scams and various fraud schemes.

In addition, countries usually differ in how they call cryptos, Germany calls it a crypto-token, Canada and China a virtual commodity and Thailand a digital currency.

In December 2020, the creators of Ripple (XRP) were sued by the SEC, alleging that it was not a virtual commodity or currency, but rather an unregistered security. The executives of Ripple executives sold 14.6 billion units of XRP through various ICOs in return for $1.4 billion to fund the company’s operations and for personal gain.

As a result, Coinbase suspended the trading of XRP in December, which would not be significant if the currency didn’t represent $17 billion of volume (9%) and $108 million of revenue (10%) in 2020. At the end of December, $1.2 billion of assets on Coinbase was in XRP, and the company expects 0 revenue going forward from the cryptocurrency.

Coinbase trading volume

You can clearly see from the chart, that any drop in cryptocurrency prices would cause a sharp drop in the assets under management and resulting revenues. Despite the inherent risk, Coinbase has been able to expand its market share over the years, and thanks to new products, the volatility of their results could decline over the coming years.

Coinbase used to rely heavily on retail traders, however starting from Q2 2019, the majority of volume traded is actually institutional. A majority of revenue still probably comes from retail (due to much higher fees), but

During 2020, the number of verified users increased by 34% to 43 million from 32 million, while transacting users went from 1 million 2.8 million (up 180%). Trading volume was up 141% to $193 billion and assets on platform increased 432% to $90 billion, mostly thanks to the significant increase in crypto prices.

The Crypto economy

A fundamental advantage of the crypto economy is that unlike the traditional financial system that relies on rigid infrastructure, crypto assets rely on software-based networks built on top of the internet. As a result, crypto assets are easily programmed, maneuvered, and as frictionless to send and receive as information on the internet.

The inherent programmability of crypto assets enables the creation of “smart contracts,” self-enforcing agreements between transacting parties directly written into lines of code. Smart contracts represent a step change in the utility of blockchain-based networks by allowing parties to enter into contractual agreements without the need for a centralized intermediary.

According to their S-1 filing: “Crypto has the potential to be as revolutionary and widely adopted as the internet. The unique properties of crypto assets naturally position them as digital alternatives to store of value analogs such as gold, enable the creation of an internet-based financial system, and provide a development platform for applications that are unimaginable today. These markets and asset classes collectively represent hundreds of trillions of dollars of value today.”

Crypto enables global peer-to-peer borrowing and lending but also allows brands and creators to create unique crypto assets (known as non-fungible tokens or "NFTs") such as digital artwork, collectibles, and fan engagement tokens, which unlock new economic opportunities for creators and their communities. NFT is another area from which Coinbase could potentially benefit in the future.

The advantage Coinbase has is mainly in their brand name, as they represent the first point of contact for many beginning crypto traders in the space. On the other hand, their revenue is mostly derived from speculation and short-term trading in crypto assets.

It’s very hard to forecast the trajectory of growth for cryptos in general, however there are some predictions that it will become more mainstream and that decentralized exchanges will take a much higher market share.4

How do users and employees rate Coinbase?

The company has a Glassdoor rating of 3.8 with a CEO approval of only 74%.5 That’s not so great, one would think that a business so entrenched in the crypto world that has done so well for such a long time would have much happier employees. Perhaps it’s because they are growing so fast, which puts a lot of strain on their people and causes a bad work life balance.

Their app has been downloaded more than 10 million times on Google Play, with an average rating of 4.4, while the Apple app store has a rating of 4.7.

The company has a very negative rating on BBB (Better Business Bureau), as many complaints go unanswered and users complain about the lack of timely support on the platform.6 Live support via messaging should be introduced sometime during 2021, so hopefully this will improve soon.7

Important facts about Coinbase

Coinbase also did a Reddit AMA which was pretty cool8, CEO Brian Armstrong answered some of the user’s questions. Here is a highlight of the most important ones:

What is the biggest existential threat? The number one threat is regulation, as they have to educate a lot of people and agencies about crypto and why it’s beneficial. The second biggest threat cybersecurity and safety of customer’s cryptowallets. Over 99% of assets are stored offline in cold storage, crypto keys are split and distributed geographically to ensure no one could access them in one place. Third one is innovation, the company needs to innovate quickly as the crypto space is changing and evolving all the time.

The fees on regular Coinbase versus Coinbase Pro are one of the worst kept secrets of all exchanges. Are there any plans to merge the platforms or reduce the fees on Coinbase? The company wants to merge these plans, as they are result of internal innovation and experimentation with various products. In addition: “And by the way, there'll be a gradient of pricing tiers as well. If you're buying a relatively small amount of crypto, the price as a percentage might be less than if you're buying millions or even hundreds of millions of dollars of crypto. So you'll see better integration of those over time, and it's a great question.”

What needs to happen for full integration of crypto payments into internet services? Are CBDCs (Central Bank Digital Currencies) going to serve that purpose? According to the CEO, it’s a problem of scalability at this point. Both Bitcoin and Ethereum are several orders of magnitude below what PayPal and Visa can do, and it needs to get to a capability of at least 5,000 transactions per second. There are innovations in this space. like the Lightning Network, Ethereum 2, Polkadot, Dfinity or Cosmos. The other two important things are usability and privacy. The payments must be able to be sent to a human readable name such as Brian@Coinbase, instead of computer readable number. Privacy is very important, as not everyone wants to transact on a public ledger. Coinbase is crypto agnostic, and they will support any currency, including the government issued ones that will probably be a large part of the crypto universe one day.

How high do you see the business risk of decentralized exchanges (DEX)? What do you see as your major USP (unique selling point in comparson to DEX? “If a customer comes in and says, "I want to convert this asset into this one," we can actually go out and connect to a number of different exchanges to get them the best pricing, even splitting up that order into a bunch of pieces…but you can imagine us making it easy to access decentralized exchanges and every other kind of decentralized app, by the way, there's thousands of them out there now, through our main retail product. So the way I think about this is whether we built it or not, we want people to be able to access it.”

What is Coinbase's stance on NFTs? Does the company have interest in incorporating them in its business model? We are very focused on supporting where our customers want to go and look forward to supporting NFTs in the future.

How much money does Coinbase earn?

The company’s numbers speak for themselves. Revenue more than doubled in 2020, and grew almost 10-fold during the first quarter of 2021. If we annualize the numbers, the company could be doing at least $7 billion in revenue this year, with $2.9 billion in net income.

The company spends most of its money on general and admin fees ($280 million) and R&D ($271 million). Sales and marketing fees were a paltry $56 million in 2020.

At the end of December 2020, Coinbase had $1.06 billion in cash and $271 million in crypto asset borrowings. They also hold $49 million in USDC, the stable coin developed by Coinbase.

Who are the largest Coinbase shareholders?

CEO Brian Armstrong holds a 21.5% stake and the second largest investor is Marc Andreesen from the venture firm Andreesen Horowitz. Fred Ehrsam, the other co-founder holds an 8.9% stake. Other investors include Ribbit Capital, Paradigm and Tiger Global. The company really has the backing of top tier investors and if they are involved in the crypto space, I have no doubts that the industry will continue to grow.

Who are Coinbase’s major competitors?

The field is very competitive, with plenty of companies offering similar services. Exchanges such as Kraken, Bitstamp, Liquid, Gemini, IDEX and many others. The platform Blockchain.com recently raised $300 million at a $5.2 billion valuation9.

Many of these platforms offer significantly lower fees for crypto trading, some of them as low as 0.1% of trade value. For example, Kraken, the platform known for a spotless security record charges 0.1%-0.26%.

This is the most significant challenge to Coinbase, as their fees seem to be significantly higher than competitors.

A Decentralized Exchange (DEX) allows users to exchange their cryptocurrency with others without an intermediary. This might pose a challenge to Coinbase in the future, but at this point the liquidity on these is still pretty low and most of volume is traded on exchanges.

What’s the fair value of shares?

WSJ recently reported10, that Coinbase's valuation reached $92 billion even before their Q1 blowout numbers. It’s very likely they will surpass $100 billion and probably even $150 billion during their first trading day.

Cryptos are probably not going away. Coinbase will continue generating significant cash flow, that will be temporarily decreased from time to time by price drops.

If we assume, that the crypto economy in general grows by 30% per year (instead of 150% like in the past), and Coinbase maintains their market share, the company could earn at least $20 billion in revenue by 2025, with profits of $8 billion. Any pressure on trading fees would have to be mitigated by introduction of new technologies or faster crypto payments. As a result, the valuation could easily surpass $200 billion in the future, assuming a 25x P/FCF multiple or 10x sales multiple.

I guess it’s just a question of belief in the future of crypto currencies and their role in the economy. If you think that Bitcoin will go to 0 and nobody will use cryptos in the future, then any price is too high.

On the other hand, I believe that cryptos are here to stay, and Coinbase will remain the dominant company in the field, whatever its shape and form might be in the future.

Major risks every Coinbase investor should know about

The majority of revenue is derived from Bitcoin and Ethereum trading, which represent roughly 77% of the entire crypto market cap. I don’t see this as a major thing, as if people switch to other crypto assets, Coinbase will be able to support them as well.

Fees from trading will very likely come under pressure. Coinbase charges fees that are significantly above industry average in many cases, and competition will drive them down sooner or later. This might temporarily depress COIN shares in the future, but as Coinbase introduces new products and technologies, they should be able to mitigate this effect in the coming years.

A particular crypto asset’s status as a “security” in any relevant jurisdiction is subject to a high degree of uncertainty and if Coinbase is unable to properly characterize a crypto asset, they may be subject to regulatory scrutiny, investigations, fines, and other penalties.

A temporary or permanent fork could affect their business. Everytime someone creates a parallel version of a coin through a protocol, it creates a new coin which is not interchangeable with the old one. This might temporarily affect trading revenue on the old coin.

Summary

COIN IPO will probably be a success, as many “stock market” people like me have been waiting for a dominant player in the blockchain space to go public. I won’t be buying it at the IPO though, as I like to avoid hype and stretched valuations. I am going to wait for a price crash in cryptos of at least 20-30% (which always comes) and use that to accumulate a position in COIN stock. The stock might do well right on the first day of the IPO and afterwards but I don’t mind that. I always target stocks that might go up 5-10x from my purchase price, missing a few % won’t make much of a difference in the long run.

I believe Coinbase will do very well over the long run as a company, precisely thanks to their two strongest points: trust and ease of use. Regardless of what happens to Bitcoin, Ethereum or other crypto coins, the blockchain technology is here to stay and Coinbase will be a significant beneficiary of it for years to come.

Furthermore, as the crypto universe expands and reliance on Bitcoin and Ethereum trading decreases, Coinbase’s revenue becomes less reliant on them, more diversified and less volatile.

Many investors think that Coinbase is just a one trick pony and will go obsolete, once Bitcoin and Ethereum drop sharply. I don’t think it’s that case. The company has built a great and trustworthy brand in the crypto space, and they will use that to launch many products as the blockchain space evolves. Nobody knows which way it’s going to go and whether digital coins will finally reach their mass acceptance, but I think that Coinbase will be here 10 years from now as a thriving and successful business.

https://help.coinbase.com/en/coinbase/trading-and-funding/pricing-and-fees/fees

https://cryptopro.app/coinbase-alternatives/

https://www.loc.gov/law/help/cryptocurrency/world-survey.php#:~:text=According%20to%20the%20Central%20Reserve,to%20cryptocurrencies%20or%20their%20equivalents.

https://www.linkedin.com/pulse/future-money-10-crypto-predictions-2021-henri-arslanian/

https://www.glassdoor.com/Overview/Working-at-Coinbase-EI_IE779622.11,19.htm

https://www.bbb.org/us/ca/san-francisco/profile/financial-services/coinbase-inc-1116-454104

https://blog.coinbase.com/an-update-on-improving-our-customer-experience-67366fe9b357

https://www.reddit.com/user/CoinbaseListing/comments/m71qrc/hey_reddit_im_brian_armstrong_ceo_and_cofounder/

https://finance.yahoo.com/news/coinbase-competitor-blockchaincom-raises-300-million-in-crypto-funding-frenzy-203955653.html

https://www.wsj.com/articles/coinbases-lofty-valuation-might-erode-as-crypto-markets-mature-11618047180