S-1 Highlights:

ARR of $141m

60% H12021 revenue growth (driven by price increases)

$15m net income in H1 2021

Net retention rate of 119% in 2019 and 98% in 2020

76% H1 2021 gross margin

$1m in ARR per employee

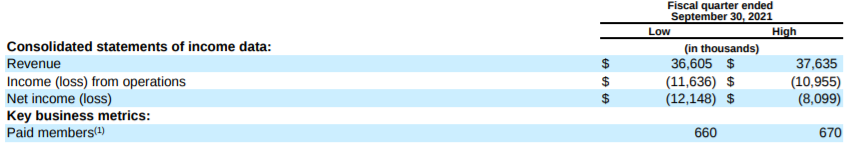

Q3 revenue estimated at $37m , operating loss $11m (bonuses)

665k paid memebers

11% of revenue comes from outside the US

Expensify went public on November 10th 2021, selling 9.7 million shares (only 2.6 million were sold by the company, rest by selling stockholders) for $27 a piece, or $262m in total. The proceeds to the company likely total less than $70m, when IPO fees are included. The shares opened at $39.7, jumping almost 50% on the first day.

The company has built a very interesting and profitable enterprise software business, so let’s take a look under the hood.

Business overview

Expensify is a cloud-based software solution that helps people and businesses of any size manage their money and expenses. Expensify is used to scan and reimburse receipts from flights, hotels, coffee shops, office supplies and ride shares. The software and apps were designed to be extremely easy to use by regular employees, not just decision makers or managers.

The company was founded in 2008 and since then processed 1.1 billion expense transactions for 10 million members. Initially, it started as a prepaid debit card idea for employees, but customers really loved their expense reporting system so the company decided to pursue that path.1

While many software companies primarily targer large enterprises, Expensify took a different path. Their main target are small and medium sized businesses, which can be approached much more easily and generate almost 3x the revenue of large ones. Companies with less than 1,000 employees accounted for 95% of Expensify’s revenue during 2020.

According to Mastercard, travel & entertainment expenses are the second largest expense item for companies after salaries2. Furthermore, it usually costs 11-23% of the original expense in additional processing, accounting, auditing and compliance costs to accurately document it.

Expensify offers a free app as well as a limited free trial period to try out their premium subscription. The advantage of offering free versions is that employees usually download the Expensify app, submit an expense report directly to their supervisor, which actually acts as a marketing message to the decision maker.

The basic features of Expensify’s app and software are:

SmartScan. Snap a photo of your receipt, forward receipts from email, or upload attachments directly in the application. SmartScan optimizes for high accuracy data extraction, however takes roughly half a minute to be completed.

Credit card matching. Receipts and emails are automatically matched to incoming credit card transactions in real-time, preventing duplicates and reducing the need to manually reconcile credit card statements at month end.

Mobile expense capture. With mobile apps for Android and iOS, it’s possible to capture receipts, mileage expenses and per diems while in the office or anywhere else in the world – online or offline. In addition, members can automatically import receipts from their favorite travel tools, including Uber, Lyft, Grab, Hotel Tonight, among others.

Revenue is derived from monthly (can be cancelled anytime) or annual contracts based on a minimum number of monthly members. The annual contracts are non-cancelable. Most of their customers pay for the subscription with a credit or debit card and have standard contracts.

Paid business plans include

Collect. The Collect plan enables paid members to integrate with popular small business accounting systems, configure simple expense report approval workflows, as well as reimburse employees, contractors and volunteers via Direct Deposit ACH.

Control. The Control plan (most popular), includes everything in Collect and adds the ability to configure rules-based approval workflows, and integrate with financial, travel, HR and other internal systems commonly used by mid-market and enterprise companies (QuickBooks, Xero, Oracle NetSuite, Sage Intacct).

In addition to the paid plans, the software helps with disbursing funds to employees and vendors:

Next day ACH (Automated Clearing House) direct deposit. For companies that enable automatic processing and reimbursement, employees receive expense reimbursements in their bank account the following business day.

Centralized travel procurement. Manage and centrally pay for travel bookings made with any Expensify Card, all while ensuring compliance with company travel policies.

Corporate card remittance. Streamline the process of managing and remitting corporate card payments

Expensify launched their own debit card for companies, which customers have begun to adopt despite COVID-19 headwinds. EXFY monetizes transactions from the Expensify Card by receiving a percentage of the interchange for all spend on the card. This has generated $1.1m in revenue in 2020, but is recorded as a contra-expense in cost of revenue, so it’s not visible in the revenue line on the income statement.

The company also recently added billing and invoicing features - the ability to automatically scan your bills and invoices and communicate directly with customers or suppliers.

Unique marketing approach

The standard way to sell B2B software is to employ a large sales force that markets directly to CFOs, CIOs or CEOs (decision makers) at large enterprises. This process is usually very costly and takes a long time (months to years).

Expensify uses their own unique “bottom up” approach to marketing, “recruiting” users to become their evangelists in the companies and spread it through word of mouth. It usually starts with a single employee downloading their free app and using it for expense management. A satisfied user then spreads the word to colleagues and afterwards the decision maker/manager purchases a subscription to Expensify. The advertising strategy is then more focused on building a strong brand and marketing Expensify as the category leader in expense management.

According to the founder David Barrett, Expensify has built a product for individuals that works very well for groups/companies. As a result, they can skip the traditional enterprise long-cycle sales approach and minimize customer acquisition costs.3

The enterprise market is overcrowded and low margin. By targeting SMBs with a unique approach, they have built a competitive advantage according to the founder.4

Based on a Netsuite report, 64% of SMBs recognize a positive ROI within a year of implementing expense management software5, which compares to 50% for large companies.

In addition to the bottom up approach, the software has integrations with Intuit, Netsuite, Xero and Intacct, which allows their customers to integrate Expensify into their back office.

Paid members and covid-19 impact

COVID-19 hit the company pretty hard and the number of paid members still hasn’t recovered to 2019 levels. Until the pandemic is eradicated and travel resumes to normal levels, their growth rate will likely remain muted.

The net retention rate (dollar revenue earned from existing customers) was 119% in 2019 and 98% in 2020, meaning a decline in spending from existing customers last year. As employees reduced travel and other work-related expenses, Expensify’s revenue declined.

The company also calculates “gross logo retention”, which divides the number of customers that currently have a subscription by the number of those who had at least 5 paying members the year prior. The gross logo retention rate was 88% in 2019 and 86% in 2020.

Product features and reviews

Here is a simple video that explains how the Expensify app works and how SmartScan helps upload bills:

The app has a 4.7/5 rating on Apple’s App Store and 4.4/5 rating on Google Play, with several million downloads.6

The product has a 4.4/5 rating on Capterra (software rating site) based on 848 reviews.7 This is better than SAP’s Concur rating of 4.2/5 but worse than Emburse (4.7 rating). Most of the reviews praise Expensify’s ease of use, but they criticize the company’s customer support, which often seems to be lacking.

Expensify uses Bedrock, a proprietary and private distributed database that they have built themselves. Bedrock enables the company to consolidate all members into a single database and maintain a direct legal relationship with each of them, where they own all their underlying data and control their account status.

Expensify has also developed Concierge, their in-house solution to customer support, which is aided by AI-assisted customer support agents. Product managers use the feedback gathered to guide the development of future functionality.

Expensify advantages

While cloud accounting platforms have made financial reporting and closing more efficient, the expense management process hasn’t changed in decades. It refers to the collection, processing, auditing and reimbursement of employee expenses. Many employees have to scan receipts and resend them to the accounting department, or bring physical copies with them. This makes the process very cumbersome and inefficient.

The main pain points that Expensify is solving and that other competitors usually lack:

Not designed for the employee, rather for managers or decision makers;

Multiple, disparate product lines for different features;

Inaccurate receipt scanning;

Lack of purposeful automation;

Lack integration with key systems and applications; and

Partitioned database design.

Expensify integrates with accounting, ERP and travel software used by SMBs and their employees every day. In addition, the platform has frictionless integrations with many of the technology providers that generate the most receipts for members, such as Uber and Lyft.

Financials

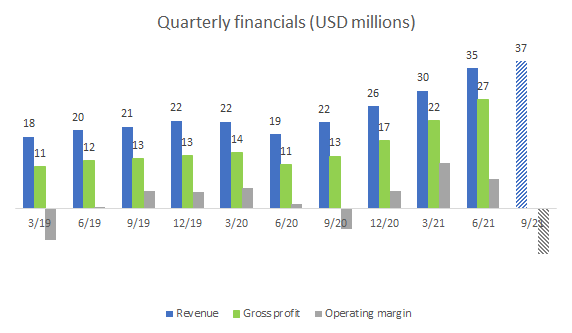

In the quarter ending June 2021, 95% of revenue came from recurring payments. Revenue was up 63% in first 6 months of 2021 and operating income tripled. As things returned back to normal and people started travelling and going for business lunches, the revenue took off.

The company has 80.9 million shares outstanding, 67 mil. class A shares, 7.3 million LT10 shares and 6.2 million LT50 shares. The LT10 and LT50 shares have 10 and 50 votes per share, compared to 1 vote per share in the class A shares. The resulting market cap is therefore $2.9 billion at the current price of $35.8.

Expensify spent only $7m on sales and marketing during the fist 6 months of 2021, or 11% of revenue. The company has reduced marketing spending due to COVID-19, from $27m spent in 2019. During 2019 they ran their first super bowl ad, which must have been expensive and that wasn’t repeated during 2020.

It’s pretty clear they were able to grow this year despite the low marketing spend, which validates their low customer acquisition cost model. But that was partially helped by the rebound in global business travel and resulting increase of activity on their platform.

In addition, they increased the per member price for customers who do not use the Expensify card for at least 50% of their expenses. These were the main drivers behind the revenue increase, as the number of paid members remains below 2019 levels. Expensify doesn’t mention the magnitude of the increase, however one review on Capterra blasted management for increasing prices by 100% and not being transparent about it.8

Gross margin jumped to 76% (from 62% last year) in H1 2021, due to operating scale and increase in revenue described above.

The company also released preliminary unaudited numbers for Q3 2021. The operating loss in September quarter is caused by bonuses of $26-$27m paid to employees in connection with the IPO. In addition, the company intends to use a part of the proceeds from IPO ($27m-$32m) to pay bonuses to employees. It’s a good idea to reward employees for their contribution, but these sums are fairly large both compared to revenue and amounts raised in IPO.

The company issued 2.6 million shares in the IPO, and a large part of cash raised will go to employees.

You can see below that growth started slowing down in March 2020 and in the second quarter revenue declined by 14% qoq. Since then, travel has rebounded and a price hike helped the company grow to its current level. YoY growth for the September quarter is expected to be c. 71%, however that’s influenced by the low point in September last year. Compared to the previous quarter, growth is just 5% which annualizes to 22% annual growth.

The company generated positive operating cash flow in both 2019 and 2020, however cash flow was negative in the fist 6 months of 2020 due to the COVID-19 impact.

Management

David Barrett is the founder and CEO, he actually started programming when he was 6 years old.

His first success came with Red Swoosh, which was a P2P sharing platform founded by Travis Kalanick (Uber).9 Barrett was the engineering manager of the company, which was later sold to Akamai Technologies for $18m.

His initial reason to start Expensify was that he wanted to build a kind of company that he and other employees would love working for. He explains that most successful companies lose their soul over time and he wanted something where that initial startup spirit would be maintained for many years.

Barrett’s explanation of Expensify’s success: “Bring aboard passionate, creative people, build an environment that encourages crazy ideas, and get out of the way as much as you can. Sure, the results can get a little weird, but weird is great. Weird is your edge. If you’re not a little weird, you’re done.”

The company has a Glassdoor rating of 4.9/5 with a 98% CEO approval rating. That’s an outstanding number and there are very few companies that are ranked so highly by their employees.

Major shareholders

David Barrett owns 13.7 million shares after the offering, or 17% of the total. OpenView Venture Partners own 10.5 million shares (13%) and Hillsven (seed venture firm) owns another 12%. Other investors include PJC and Octopus Head.

Competition

The expense management software market is extremely competitive, with large and established players like Intuit, Oracle Corporation (NetSuite), SAP AG (Concur) battling for control. However, Expensify smartly shifted their focus to SMBs, many of which still haven’t digitized their processes and rely on manual tasks.

In a recent interview, the CEO explained that they focus on SMB segment because there is very little competition there. The enterprise segment might be dominated by Concur (SAP), but most of the small businesses have never heard of it.10 He also mentioned, that their revenue from SMBs is 3 times larger than that from large companies.

Nevetheless, there are dozens of solutions even in the SMB market: Bento, Brex, Divvy, Emburse (Certify, Abacus and Nexonia), Expensya, Fyle, Happay, Pleo, Ramp, Spendesk, TravelBank.11

In addition, Bill.com (BILL) purchased expense management software company Divvy in May 2021 for $2.5 billion at a valuation of 25x ARR.12 Divvy was growing by triple digits when acquired and will be integrated into BILL’s back office software.

Market size

The company estimates their TAM (total addressable market) at $21.5 billion. This includes $16b in US, $1.6b in Australia, $2.3b in UK and $1.7b in Canada. The US market is divided into segments: Enterprise $7.1b, Mid-market $1.5b, SMBs $12b and VSBs ($2.4b).

In addition to this, the addressable market for their card solution is $17 billion according to the company. This was derived as the average take rate in the sector multiplied by the volume of credit card spend by SMBs.

The company believes that there is significant room for long-term growth, as the vast majority of SMBs in their core geographies have not adopted software based expense management tools and are instead relying on manual processes.

According to the founder’s letter in S-1, there are over 100 million businesses in the world, and only 0.1% of them use some form of modern expense management.

Is EXFY stock cheap?

At the current price of $35.8 and market cap of $2.9 billion, Expensify is selling for 21x ARR. That’s cheaper than what Divvy was purchased for, but that company was growing faster. Expensify is a good business with high margins and recurring revenue, however their growth was impacted by the price hike last year. The fact they have pricing power is a very positive sign, however that’s not sustainable.

Based on operating cash flow of $24m in H1 2021, the company will likely generate at least $30-$40m of free cash flow this year. So that’s 73x P/FCF, which is not exactly cheap.

Organic growth (number of paying members) is muted due to covid restrictions on business travel. If the virus situation improves significantly in the next 18 months, EXFY could get a big boost to revenue from increased travel.

The competitive advantage (or moat) might not be as strong at EXFY yet. The SMB segment is vulnerable to economic shocks and the churn rate (12-14%) is fairly high. Gross margin has jumped to 76% thanks to their price hike, but we’ll see how sustainable that is in the long run.

At the current price, the stock still seems expensive. However, if you believe that business travel will return to normal in the next 2 years, then it might be a bargain.

Conclusion

Expensify is a great and profitable business and a category leader in SMB expense management. A profitable and growing tech company is a rarity these days, and they have weathered COVID-19 very well, thanks to annual contracts and price hikes.

The stock seems a bit expensive at this point, but if it keeps declining further, it might be a decent long-term opportunity (5-10 years). The thing that worries me the most is that the competitive advantage doesn’t seem to be that strong and that competition seems pretty intense even in the SMB niche.

https://openviewpartners.com/blog/why-expensify-almost-didnt-happen/#.YanRItDMJPY

https://www.mastercard.us/content/dam/mccom/en-us/business-payments/documents/MCUS_18034_TE-WhitePaper-ReDesign_V4.pdf

https://review.firstround.com/expensifys-ceo-on-the-tactics-that-doubled-its-customer-base-in-just-six-months

https://www.protocol.com/fintech/expensify-fintech-ipo-david-barrett

https://www.netsuite.com/portal/resource/articles/financial-management/expense-management-industry-trends.shtml

https://apps.apple.com/us/app/expensify-receipts-expenses/id471713959

https://www.capterra.com/p/97594/Expensify/

https://www.capterra.com/p/97594/Expensify/reviews/

https://techcrunch.com/2021/05/10/expensify-ec1-origin/

https://finance.yahoo.com/news/expensify-different-business-model-ceo-says-132622012.html

https://www.g2.com/categories/expense-management

https://techcrunch.com/2021/05/06/why-did-bill-com-pay-2-5b-for-divvy/