Genmab (GMAB): An emerging biotech powerhouse worth $26 billion

The company's investments in its own pipeline and technology platforms is bearing fruit

Genmab (GMAB) is a Danish biotechnology company with expected 2022 revenues of $2 billion, employing more than 1,200 people. The company has developed a proprietary antibody platform and drugs targeting various types of cancer in collaboration with major pharma and biotech players.

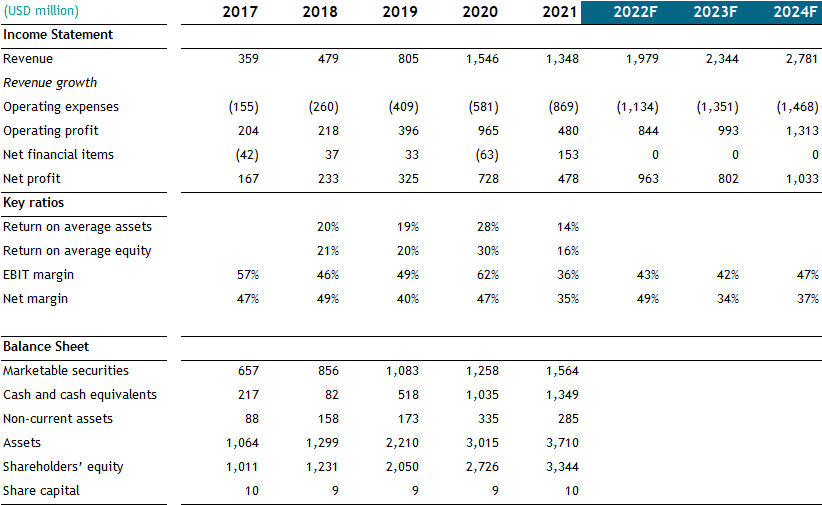

The company has grown its revenue more than 5x since 2017, with operating income increasing 322% during that period. GMAB earns very high returns on capital, with ROA of 62% when adjusting total assets for cash and marketable securities. The company is very profitable, with a forecasted operating margin of 43% for 2022. Genmab’s revenue in 2020 was impacted by a $750 million upfront payment from AbbVie, which purchased the rights to market epcoritamab in various countries. In 2019, the company received a major milestone payment from Janssen, which caused a jump in revenue.

Genmab was originally formed in 1999 in Copenhagen, Denmark, after a group of Danish investors purchased a spin-off company from US biotech Medarex. They initially struggled and had to undergo a restructuring, selling its production assets, outsourcing manufacturing and firing almost 70% of workforce in 2008 crisis. To survive and raise cash, the company lowered their royalty share with GSK in relation to drug Arzerra, for which they received an upfront payment.1

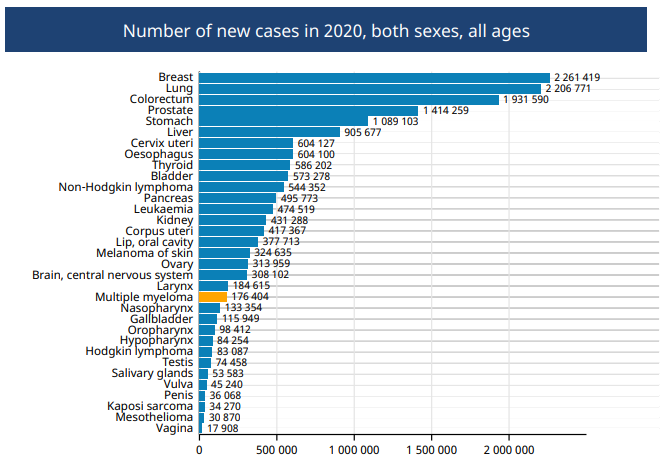

Genmab became a big success thanks to their blockbuster drug Darzalex, co-developed with Janssen Biotech (Johnson &Johnson). The drug targets multiple myeloma (MM), a rare form of cancer that affects hundreds of thousands of people globally, with 180k new cases and 100k deaths each year.

MM targets plasma cells, which normally produce anitbodies that help you fight germs and infections. The cancerous plasma cells accumulate in the bone marrow and produce abnormal proteins, that cause kidney failure, bone pain and ultimately death.

MM is not as prevalent as other types of cancer, however it is very deadly with a median 5-year survival rate of only 54%.2

Over the past 9 months, Genmab derived roughly 88% of its revenue from royalties, with 86% of royalty revenue coming from Darzalex. As a result, the drug represents 75% of total revenue.

DARZALEX (Daratumumab)

Net sales of DARZALEX by Janssen were USD 5,894 million in the first nine months of 2022, an increase of 35%. The strong growth shown in DKK is due to the depreciation of Danish krone, as well as higher royalty share due to Genmab. The company generally makes 12-20% on sales of Darzalex, depending on the total amount. In addition, the US dollar appreciated against the Danish currency, which increases the total amount earned in DKK. Growth in USD amounted to 51%, a very high number nonetheless.

Genmab lost a lawsuit against J&J (Janssen), which aimed to extend royalties until the last J&J patent expires. Instead, the jury sided with J&J and royalties will be paid until the last Genmab patent expires, which should be in the early 2030s. In 2022, Janssen decreased the royalty payments due to Genmab, as the subcutaneous drug delivery of Darzalex’s Faspro formulation uses a technology developed by another biotech Halozyme.

Janssen alleged, that Genmab should be paying for the technology as well and as a result decreased the royalties from Darzalex to Genmab. Genmab will probably appeal but it is very likely that royalties will be decreased by the amount due to Halozyme in future years. Genmab estimated the payments were worth $67 million in 2021, a sizable amount of money but doesn’t represent a major risk at around 5% of revenue. Furthermore, I believe this has already been discounted in the stock price.

Just two years ago, Darzalex was the only approved product of Genmab. They now have a total of 6 approved products with a strong pipeline.

TEPEZZA (Teprotumumab)

Tepezza is a drug co-developed with Horizon Therapeutics plc for the treatment of thyroid eye disease (TED). TED is an autoimmune disease that is more prevalent with women than men and affects roughly 16 women per 100,000 and 2.9 men per 100,000. It causes inflammation and damage to the tissue around the eye. Patients usually seek treatment when they notice swollen eyelids. The estimated number of people with TED in US is 15,000-20,000.3

Tepezza was launched in February 2020 and is the first approved therapy for TED. The drug has caused controversy recently, with 1 out of 3 patients developing hearing issues.4 Royalties from Tepezza declined 7% YoY at Genmab and Horizon Therapeutics recorded a 20% decline in Q3.5 It's currently unclear how this will affect future sales of the drug, but growth is unlikely to resume at this point. Tepezza represented 5% of Genmab's sales in Q3 2022.

Kesimpta (Ofatumumab)

The drug was co-developed with Novartis, which is also responsible for its marketing around the world. Kesimpta is used to treat relapsing multiple sclerosis. Multiple sclerosis (MS) is an autoimmune disease, which causes the immune system to attack the protective sheaths that cover nerve fibers, causing communication issues between the brain and parts of your body and can permanently damage your nerves.

MS affects approximately 2.3 million people worldwide. It is often characterized into the following forms: primary progressive MS (“PPMS”) and RMS, which includes relapsing-remitting MS (“RRMS”) and secondary progressive MS (“SPMS”). Approximately 85% of patients have RRMS.

There is no cure for MS, treatment usually focuses on slowing down the progress of the disease or speeding recovery from attacks.

While there are several treatment options for MS, Kesimpta mainly competes with Roche’s Ocrevus, which is the dominant drug in the field with an estimated market share of 40%.6 Kesimpta can be administered by the patient at a home using a pen, compared to treatment at a clinic for Ocrevus. This would be a significant benefit for patients as it adds more convenience and also creates savings in the healthcare system.

Royalty revenue from Kesimpta grew 223% in USD, demonstrating strong interest from patients. Genmab earns a 10% royalty from Novartis on Kesimpta sales. Ocrevus recorded sales of c. $1.5 billion per quarter for Roche and is the company's top selling drug. If Kesimpta challenges its position, the drug could be a significant growth driver for Genmab, as the gloal MS market is worth an estimated $25 billion.7

RYBREVANT (Amivantamab)

Co-developed with Janssen, the drug targets non-small-cell lung cancer (NSCLC) with epidermal growth factor receptor (EGFR) exon 20 insertion mutations, which are found in 2% to 3% of patients with no current treatments available. Genmab earns 8% to 10% royalties on sales of Rybrevant. Janssen has expanded the clinical studies of the drug to more common forms of lung cancer. Rybrevant has also demonstrated clinical efficacy in its trials, shrinking tumors in 40% of patients and extending their lives.8 Janssen received FDA approval for the drug in Q2 2021, but sales have been immaterial since then.

TECVAYLI

Another drug that was developed in co-operation with Janssen. Both FDA and European Medicines Agency approved the drug for the treatment of relapsing multiple myeloma, but as a late-line therapy. This means that it’s only available to patients who have already tried several other medications and still get relapses. Despite this, the drug is easier to manufacture than some competing products and has proven clinical efficacy in trials. Analysts from SVB Securities estimate it could pull in $2 billion in revenue for Janssen and Genmab is entitled to milestone payments and mid-single digit royalties9.

TIVDAK (Tisotumab Vedotin)

Tivdak received accelerated FDA approval for treatment of recurrent or metastatic cervical cancer. The treatment was developed with help of Seagen, and Genmab will receive 50% of sales and incur 50% of costs under this collaboration. For sales outside US, EU and Japan, GMAB will receive royalties of mid-teens to mid-twenties. Seagen will lead commercial activities in US, Europe and China while Genmab will be the leader in Japan.

Tivdak faces strong competition from Merck’s drug Keytruda, which is approved as a first-line treatment for cervical cancer patients. Genmab intends to improve the drug’s positioning as a first-line therapy or in combination with Keytruda. There are only 4,000 patients in US with cervical cancer, while more than 600,000 cases have been recorded globally in 2020. Cervical cancer used to be one of the leading causes of death for women in US, however cancer screening tests have helped reduce the number of cases to a minimum.

Seagen started selling Tivdak in Q3 2021, and the drug recorded Q3 2022 sales of only $16 million, down from $17 million in the previous quarter. This is unlikely to move the needle for Genmab.

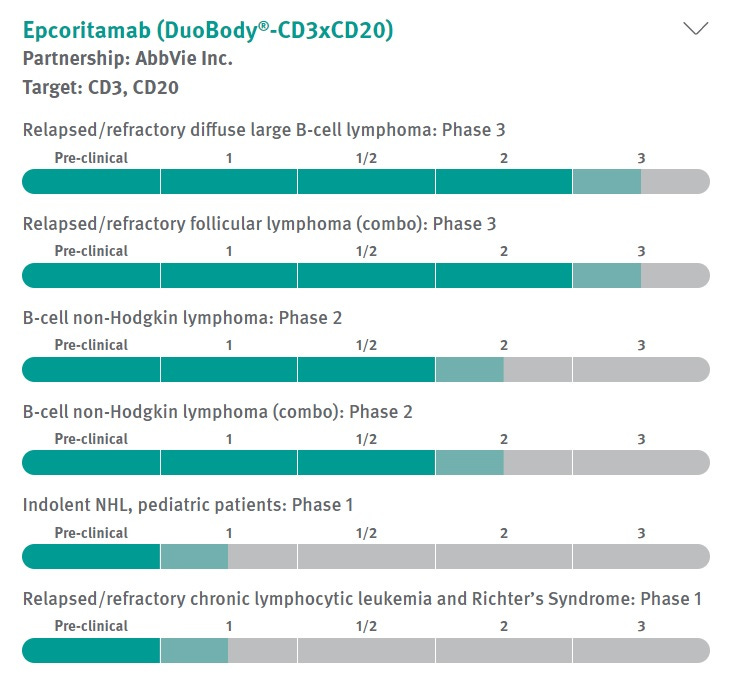

Epcoritamab

Bispecific antibody-based investigational medicine created with Genmab’s DuoBody technology platform in collaboration with AbbVie. There are multiple clinical studies ongoing targeting b-cell lymphoma. Genmab submitted a BLA (Biologics license application) to FDA for priority approval for the treatment of relapsed or refractory large B-cell lymphoma (LBCL) after two or more lines of systemic therapy. The drug could reach the market in 2023, however, some analysts have noted its inferior safety profile due to prevalence of Cytokine release syndrome(CRS)10. It occurred in 49.7% of patients, but only 2.5% of patients had a grade 3 or higher event and there were no grade 4 or 5 events.

Despite that, the drug proved to be quite efficient during clinical studies and Jefferies analysts estimated peak sales of $2.75 billion.11 It is being currently evaluated in 6 different clinical studies on various types of cancer. Genmab will receive 50% of sales in US and Japan and 22-26% in international markets.12 The potential milestone payments associated with epcoritamab are worth $3.2 billion, and Genmab's guidance for 2022 assumes the receipt of a milestone payment from Abbvie for FDA's acceptance of the drug.

Clinical Stage Investigational Medicines

Genmab has a strong pipeline of treatments targeting various diseases and using both their own technology platform DuoBody and BMS’s UltiMAb.

Genmab’s sales will be powered mainly by the growth of Darzalex (at least until 2030), with some help from Kesimpta and Epcoritamab. Tivdak and Rybrevant have so far recorded underwhelming sales, and there are no indications that this would change any time soon. Epcoritamab looks very promising and could be used as a treatment for various types of cancers and could potentially reach blockbuster status.

Management

Genmab is led by Jan van de Winkel who became CEO in 2010 and has led the successful turnaround of the business. He was originally the scientific director in Medarex’s European division, before it was bought and rebranded as Genmab. Van de Winkel holds 1% of shares, which is not a major position but it’s worth almost $300 million at current prices, giving him significant incentives to grow the business further.

Here is an older video (2018/2019) with Jan van de Winkel. He talks about the potential of Darzalex to treat other forms of cancer, not only MM:

His aim is to increase the share of revenue that Genmab gets from partnerships and grow the company to become a European biotech powerhouse13. In 2012 when it licensed Darzalex, the company had no negotiating power and had to settle for royalties of 12-20% with Janssen. However, the last parterships signed with BioNtech, AbbVie and Seagen are all 50:50 suggesting significant upside if any of these drugs turn out to be blockbusters.

The company has a Glassdoor rating of 4.1/5 with a CEO approval rating of 83%.

Valuation

GMAB has a current market cap of $29 billion, with a cash position of $3.3 billion and only $550 million in lease liabilities. The enterprise value is therefore $26.2 billion, or 13x forward sales and 31x forward 2022 EBIT. While that might seem like a demanding valuation, the company has a strong competitive position with Darzalex and Kesimpta, recurring revenues protected by patents and very high free cash flow margins.

Summary

Genmab’s revenue is mostly derived from Darzalex, which is still growing by 30%+ and could be potentially used to treat other types of cancer.

The company is also developing HexaBody-CD38, a human CD38 monoclonal antibody-based investigational medicine created using Genmab’s HexaBody technology platform. In preclinical models of hematological malignancies, HexaBody-CD38 demonstrated highly potent complement-dependent cytotoxicity and showed potent antitumor activity. If proven successful, this could be potential successor of Darzalex and even more potent in treating cancer. Genmab would receive a royalty of 20% on sales of CD38 and milestone payments worth hundreds of millions. It is still too early to tell, as the clinical studies have begun only in 2021.

Kesimpta is another very promising drug with excellent clinical results and strong patient uptake reflected in triple digit growth this year. It seems to be superior in some ways to Roche’s Ocrevus, which could help it capture more market share in future years.

While the stock isn’t exactly a screaming buy at these prices, an investor is essentially paying 26x forward 2023 EBIT, which is not such a steep multiple for a high quality biotech company with recurring royalty revenue streams and a promising pipeline. Jan van de Winkel has turned a struggling biotech into a global powerhouse and in the next few years, the company will derive a much larger percentage of its revenue from drugs developed and commercialized in-house.

The company has a strong position in the MM market and will likely continue to grow for years to come generating significant free cash flow. I believe the shares are cheap at current prices and could offer double-digit returns for the next 5 years.

https://pharmaphorum.com/views-and-analysis/jan-van-de-winkel-building-europes-biotech-powerhouse-at-genmab/

https://en.wikipedia.org/wiki/Multiple_myeloma#Signs_and_symptoms

https://www.fiercepharma.com/pharma/horizon-notches-fda-approval-for-rare-eye-disease-med-tepezza

https://www.aboutlawsuits.com/tepezza-hearing-problems-study/

https://www.businesswire.com/news/home/20221031005857/en/Horizon-Therapeutics-plc-Reports-Third-Quarter-2022-Financial-Results-Increases-Full-Year-2022-Net-Sales-and-Adjusted-EBITDA-Guidance-Increases-TEPEZZA-and-KRYSTEXXA-Peak-Annual-Net-Sales-Expectations

https://www.fiercepharma.com/pharma/roche-playing-against-novartis-kesimpta-touts-ocrevus-benefits-treating-ms-early

https://www.fortunebusinessinsights.com/industry-reports/multiple-sclerosis-drugs-market-100386

https://www.fiercepharma.com/pharma/johnson-johnson-snares-fda-green-light-for-first-ever-treatment-group-mutation-specific-non

https://www.fiercepharma.com/pharma/jjs-bcma-bispecific-tecvayli-wins-fda-approval-multiple-myeloma-again-late-line

https://www.fiercebiotech.com/biotech/chasing-roche-abbvie-posts-data-cd20-blood-cancer-bispecific-ahead-race-regulators

https://www.fiercebiotech.com/biotech/chasing-roche-abbvie-posts-data-cd20-blood-cancer-bispecific-ahead-race-regulators

https://www.fiercebiotech.com/biotech/abbvie-to-pay-genmab-750m-upfront-to-form-bispecific-r-d-pact

https://pharmaboardroom.com/articles/genmab-ceo-on-5050-partnerships-creating-iconic-innovation-powerhouse/