ICICI Bank (IBN): Strong franchise with years of double-digit growth ahead

The stock is still very cheap at current valuations, given their growth potential

Successful turnaround of ICICI since CEO Sandeep Bakhshi took over in 2018

Net margin improved from just 3% to 17% in 2022

Double digit growth in interest and fee income, profits in latest quarter

Undemanding valuation at 17x forward P/E

Public banks in India still hold 60% market share, but losing rapidly to private ones

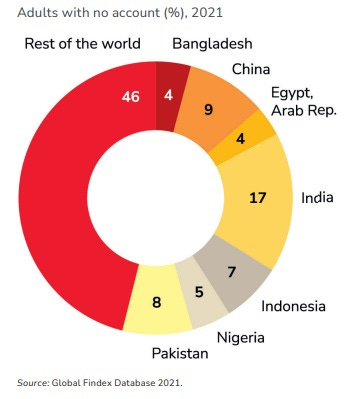

17% of adults in India have no bank accounts, just 0.05 credit cards per person

India’s forecasted GDP growth at 6% for 2023-2025, above China and US

ICICI Bank (IBN) is the second largest private bank in India. It derives most of its revenue from commercial banking services provided to retail and corporate customers. These include lending, deposit taking, distribution of insurance and investment products, forex and derivative products to corporates and other fee-based products and services such as debit or credit cards.

ICICI is also engaged in insurance, asset management, securities broking business and private equity fund management through specialized subsidiaries.

The company was initially formed in 1955 at the initiative of the World Bank, the Government of India and leading Indian industry figures. The objective was to create a financial institution that would aid in the development of India, by providing long-term loans to Indian companies. Thanks to the liberalization of the financial sector in India during the 1990s, the bank transformed itself to a diversified financial services group, offering retail banking, insurance, mutual funds and other financial products. The bank had a network of 5,614 branches and 13,254 ATMs at September 30, 2022.

IBN has a market cap of $77 billion (6.3 trillion INR) with $3.6 billion in net earnings over the past 12 months. The company has 3.5 billion shares outstanding with an ADR price of 22.3 USD.

Below is a summary P&L (INR billions) for ICICI Bank and key KPIs (current USD/INR is 82.2):

Profitability and asset quality has improved dramatically in recent years, with net income rising almost 4-fold from 2018 levels while net non-performing assets (NPA) decreased from 4.77% to 0.61%. Consolidated return on average equity has reached 16%, the highest figure in at least 6 years.

Previous scandals and successful turnaround

From 2010 to 2018, ICICI Bank went through a tumultous period that included several high-profile scandals. During 2012-2017, the bank lent substantial amounts (Rs. Crore 7,000) to ABG Shipyard (major shipbuilding company), while an EY audit in 2019 uncovered that the money was siphoned off and lent out to related parties by the company’s management.

Chanda Kochhar, the previous CEO (2009-2018) of ICICI Bank was ousted due to fraud and violations of internal bank policies. During her tenure, the bank advanced loans worth hundreds of millions of dollars to Videocon Industries, in exchange for an investment provided by its owner Venugopal Dhoot in a business headed by Ms Kochhar's husband.

In addition, several clients of ICICI have previously hired services of Avista Advisory Group, which is run by Chanda Kochhar's brother-in-law Rajiv Kochhar (brother of Deepak Kochhar).

The bank was also investigated by the SEC regarding loan provisions for the period before 2017, but ultimately the investigation was concluded and no enforcement action was taken by the regulator.

Chanda Kochhar and her husband were arrested in 2020 and released on bail a few months later. The trial with both of them is ongoing.

ICICI Bank has a very troubled past but the bank’s fortunes have turned significantly thanks to new CEO Sandeep Bakhshi, who improved the company’s image, employee morale, financial stability and profitability in just 4 years.

Current management

Sandeep Bakhshi was born in 1960, has been with ICICI for 36 years and was appointed MD and CEO in October 2018, after successfully heading the ICICI Prudential insurance arm. Bakhshi inherited an institution that was plagued by scandals, recorded high NPAs and low profitability ratios and suffered from bad employee morale.

He wasted no time and implemented a “One Bank, One ROE” policy, which suggested a focus on profitability across its portfolio over growth or market share. He simplified the product structure, increased focus on customer service and decentralized the management structure. He downsized the special project finance group, which historically advanced large loans to corporates and was a source of the bank's many problems. According to some employees, the new decentralized management approach has boosted employee morale and productivity.1

Bakhshi overhauled the incentive and remuneration system, instituting a fixed bonus percentage across all the bank’s levels. He gave up his bonus and fixed compensation in FY21 (pandemic year) and ordered an 8% salary increase for front-line branch staff.

Risk management became a core focus, and Bakhshi constantly reminded employees, that a “bank makes 3 percent on a good loan but loses 100 percent on a bad one”. Technology is at the core of the bank’s strategy, and the company has invested substantial sums into their apps as well as risk management, compliance and communications systems.

Bakhshi sees himself as a temporary steward of the bank, and his aim is for the institution to survive and thrive for the next 100 years.

ICICI key financials and credit quality

ICICI Bank recently reported results for Q2 2023 (ending Sep 2022). Net interest margin reached 4.31%, with return on assets climbing to 2.06% and standalone ROE (just the bank, excl. insurance and investment subsidiaries) increasing to 16.6%.

The company’s loan portfolio is composed mostly of housing, car and personal loans to retail clients, which together represent 54% of all loans. Corporate and business banking made up 34% of the loan book, while the rest was rural (9%) and overseas (4%). The bank appears to be well-diversified across various segments.

The vast majority of overseas loans were granted to Indian companies operating abroad. The bank is firing on all cylinders on the domestic market, but seems to have retrenched from its international activities, which comprised 11% in FY19 but shrunk to 4% by September 2022.

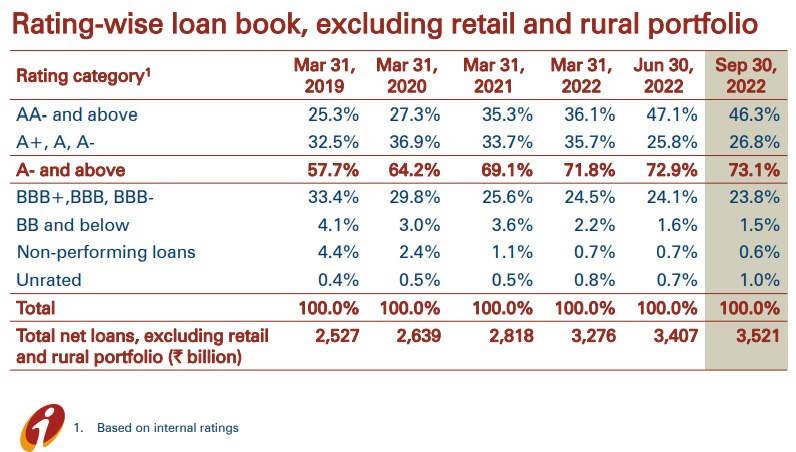

IBN runs an internal risk control system, which assigns ratings to corporate loans. Loans with ratings A- and above represented 73.1% of the total in September 2022, compared to 58% in March 2019. Loans rated below A- went from 37.5% in 2019 to 25.3% today. Non-performing corporate loans were just 0.6% in the last quarter versus a staggering 4.4% in 2019. The bank has significantly improved the quality of its portfolio, while simultaneously increasing its profitability.

During the last quarter, credit card spend went up 43.1%, while the bank added 600,000 net credit cards to its portfolio, after shutting down 800,000 inactive cards according to RBI guidelines. Based on IBN’s 2022 annual report, the market share in credit card transactions was 20% in that year, up from 14.6% in 2021.

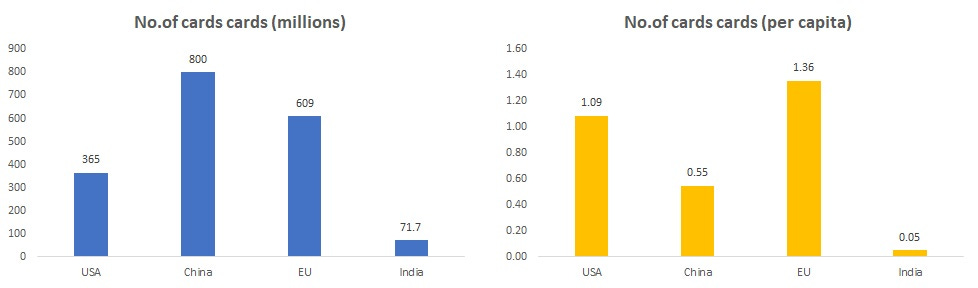

ICICI is the second largest private bank in India and has only 13.3 million credit cards outstanding. In fact, the total number of credit cards in India is just 72 million, or 0.05 per capita!2 Compare this to US or Europe which have more than 1 credit card per person. Even China has a per capita credit card ownership that's 10 times higher than India's. The banking sector in India is still in its early innings and there is significant room for further growth.

The banks return on average assets has improved from just 0.4% to 2% in the last quarter, on par with leading banks in the country and around the world. Return on average equity went from a paltry 4% to 17%.

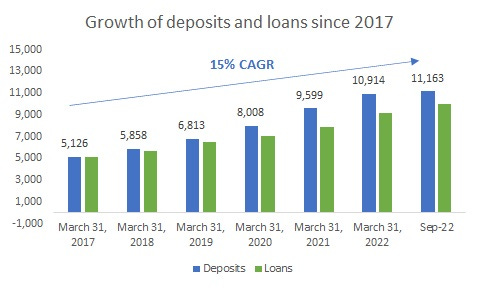

The bank’s deposits have grown at 15% per year since 2017, while loans grew at a CAGR of 13%. The bank can maintain a double-digit growth rate for years, as there are still tens of millions of Indians without bank accounts or credit cards. As India’s GDP expands, the banking sector grows in tandem thanks to increased economic activity.

Technology focus (iMobile app and data analytics)

In December 2020, the bank launched its flagship iMobile app, which attracted millions of downloads from non-ICICI customers3 in only 6 months. The app has since been activated 8 million times by non-ICICI customers and has a rating of 4.7/5 on the Google Play store4. In contrast, the HDFC banking app has a rating of 4.2 by 900k reviewers, compared to 3.8 million reviews on iMobile.

The app has since been transformed into an open-architecture universal app, allowing non-bank retail and business customers to use it for payments and other financial products.

The feature ‘Pay to Contact’ enables users to automatically see the UPI (Unified Payments Interface) IDs of their phone contacts and easily transfer money to any payment app or digital wallet via UPI. UPI is a payment system developed in India for inter-bank peer-to-peer and person-to-merchant transactions.

The ‘Scan to Pay’ feature allows users to make bill payments by scanning the QR code. Other features introduced on iMobile Pay include 'Tap-to-Pay' which enables customers to make card payments without the need to carry a physical card, linking nonICICI Bank credit cards in the app for payments, outward remittances and smart checkout.

The feature Money2World allows users to send remittances around the world. All of these efforts have led to a sharp increase in digital payments across their various channels.

InstaBIZ is an app for businesses, and it’s an integral part of the iMobile universal app. Companies can apply for UPI ID and QR code and start collecting money from their customers immediately. They can also open current accounts digitally through the app, without going to a physical branch.

The bank has developed a truly open ecosystem with over 600 APIs for retail and 85 APIs for corporate banking.

ICICI has a dedicated data science and analytics team that works across business areas on projects relating to business analytics, decision strategies, forecasting models, machine learning, rule engines and performance monitoring. The company maintains an enterprise-wide data warehouse and employ statistical and modelling tools for leading-edge analytics.

A key underpinning of the Bank’s customer-centric and service-oriented approach has been to develop a granular perspective on markets through use of data analytics and market intelligence. This research and knowledge through analytics helps the frontline teams to understand the markets in which they operate, and plan localised strategies with tailored propositions for customers. The insights from the micromarket analysis are used in conjunction with other factors for planning, resourcing, channel and product alignment, capability building and marketing and alliances. ICICI has categorised certain branches under different affinities based on the nature of the micromarket catchments in which they operate. Branch layouts, branding elements, staffing and capability building in these branches are based on their market affinities. Micromarket insights have helped the Bank to identify optimal locations for opening new branches and for realigning its ATMs and distribution network based on customer needs and market opportunity.

During FY22, digital channels accounted for over 90% of savings account financial and non-financial transactions.

Indian banking sector and key competitors

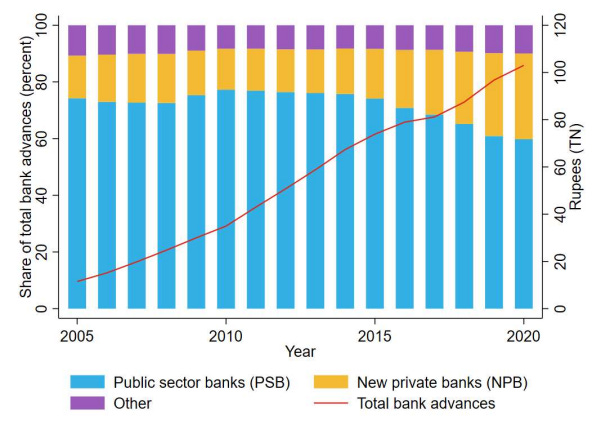

India’s banking sector is fairly competitive with 12 large public banks, 22 private banks, 46 foreign banks, 56 regional rural banks and thousands of rural and urban cooperative banks. Historically, state-owned lenders have held the largest market share, but this has been eroded recently by the advance of private banks:

Outstanding bank credit by bank ownership type

In 2010, state-owned banks held more than 75% market share, while by 2020 this has declined below 60%. The private sector banks are better run, more efficient and have lower non-performing loan ratios, suggesting they will continue taking market share from public banks.

There are several strong competitors present on the market, especially HDFC Bank (HDB) and Kotak Mahindra Bank. SBI (State Bank of India) is the largest bank by revenue, however it lags in profit, market cap, return on assets and equity as well as growth. It’s evident that private banks are slowly chipping away at its share.

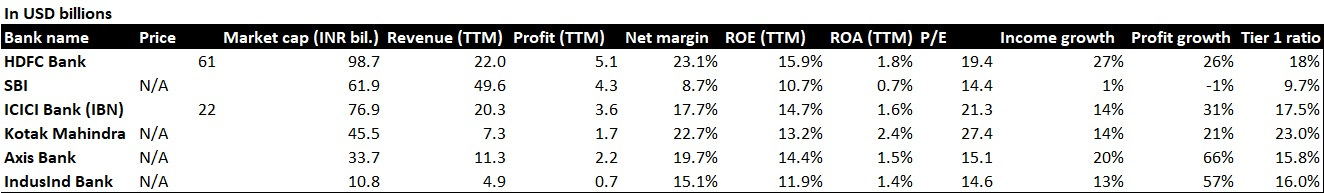

ICICI Bank’s key competitors

IBN’s net margin, ROA and ROE both lag the top two players HDFC and Kotak Mahindra. However, I believe that the company is improving very fast and with Sandeep Bakhshi at the helm, it will only be a question of time before they catch up to rivals in profitability. HDFC Bank is growin faster than peers, thanks to 23% loan growth in the quarter ending September 2022. ICICI Bank on the other hand has expanded its profits at a higher clip than HDFC and Kotak Mahindra, as margins steadily improve. Here is the same table just translated to USD using the current USD/INR exchange rate of 82.2:

HDFC Bank earns the highest profits at $5.1 billion and the bank has recently anounced a merger with HDFC (Housing Development Finance Corporation) to form a $150 billion financial giant with a clear no.1 position on the Indian market.5 HDFC Bank was founded as a subsidiary of HDFC, which itself was created in 1977 with the help of ICICI. HDFC held a 26% stake in HDFC Bank and now both companies will merge, with the transaction consumating sometime in 2023.

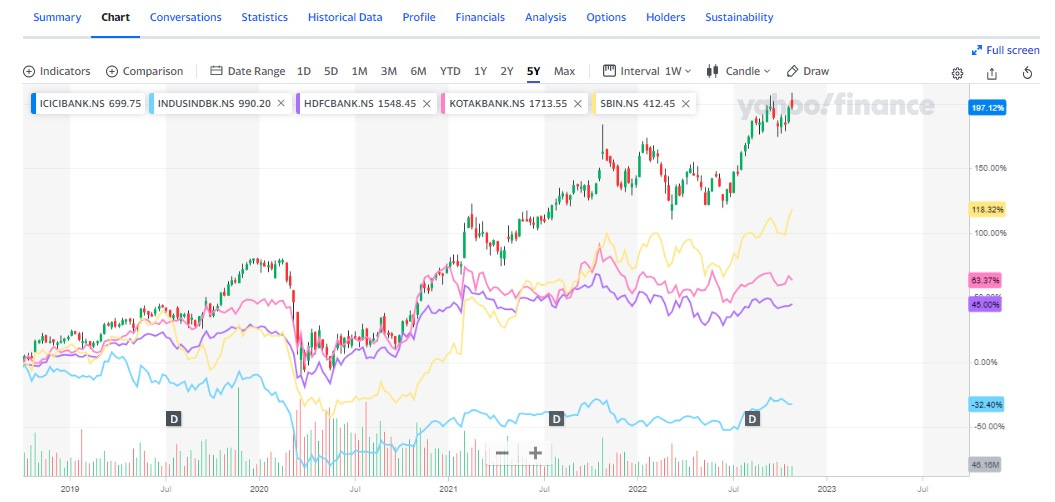

Since 2020, HDFC Bank went through a series of problems related to technical issues. After several outages caused problems for the bank’s customers, RBI (Reserve Bank of India) banned the digital issuance of credit cards by HDFC and forced the bank to stop several of their digital initiatives. According to Forbes India, ICICI has gained 6.5% in market share of credit card spend compared to HDFC bank.6 Thanks to significant investments in technology at ICICI, the bank has mostly avoided such technical issues. The gain in market share and technology leadership are some of the reasons why ICICI Bank's stock has outperformed HDFC Bank over the past 2 years.

ICICI Bank is catching up to HDFC and has surpassed SBI in market capitalization. It will not be an easy battle, but I believe that ICICI Bank can improve profit margins further, keep their double-digit income growth and improve its competitive position in future years.

ICICI Bank, Kotak Mahindra and HDFC Bank are the leading banks on the Indian market and that’s unlikely to change anytime soon.

Indian economic outlook

India has the highest forecasted GDP growth among major economies in the world. It was hit quite hard by COVID but rebounded quickly and the expectations for 2023-2025 are still for growth above 6%, outperforming US, China and the Eurozone.

Forecasted GDP growth (2022-2025)7

According to the World Bank, 17% of adults in India did not have a bank account, with 75% of them women. This represents a tremendous opportunity for banks to grow their customer base.

The indian banking sector is highly concentrated, with the top 3 banks controlling 55% of the total banking assets.8 In each major economy, banking is usually an oligopoly with switching costs, the major banks maintain their dominant position for years as customers are unwilling to switch and open account at competing banks to save a little bit on account fees. Given ICICI’s position as the 2nd largest private bank in India, I expect them to not only maintain their share but to expand as they take customers from SBI, other state banks or even from HDFC.

The share of non-performing loans (NPLs) in India is still very high compared to the rest of the economies in Asia-Pacific. This is mainly tied to loan portfolios of state-owned banks, which have lent capital very recklessly in the past:

Share of non-performing loans out of total loans

Over the past two years, the MSCI India ETF (INDA) has outperformed the S&P500, MSCI World (URTH) and MSCI Emerging markets (EEM) indices:

I’m a fan of investing in assets and securities that experience strong relative strength indications, and the outperformance of Indian equities might be a start of a longer term trend.

In addition, shares of ICICI Bank have outperformed the domestic rivals over the past two years and five years. They are up almost 200% since Sandeep Bakhshi took over.

UPI (Unified Payments Interface)

In 2016, the National Payment Corporation of India under the guidance of RBI launched a new payment system called UPI (Unified Payments Interface). Users create a unique payment ID9 (tied to their smartphone), which allows them to pay instant peer-to-peer or person-to-merchant payments with zero fees. After just 5 years, UPI grew from 0 to 63 trillion INR in transactions ($768 billion) in 2021, and by July 2022, over 200 million transactions were recorded every day. UPI essentially connects two banks accounts through a unique ID, without sharing the account information or any sensitive details. As the network gained in popularity, more banks and technology companies joined and now it’s support by a robust ecosystem of local players.

The main advantage of using the system is its simplicity, security and zero fees. This poses a major threat to card networks such as Visa and Mastercard, which usually charge 1-3% in Merchant discount rates (MDR) on debit and credit card payments. As UPI payments link two bank accounts directly, they bypass the Visa and Mastercard network.

As UPI has surged in popularity, debit card usage has declined as it’s more safe and user-friendly to pay with UPI. This means that merchants no longer pay the MDR to card networks and this lowers the cost of transactions across the whole economy.

Digital payments in India have climbed to $444 billion this year, with UPI representing 50% of that.10 According to a report from Goldman Sachs, digital payments are expected to grow by 28% per year until 2026, reaching $1.2 trillion.

The RBI has recently proposed to link credit cards to UPI, which would allow consumers to buy on credit through UPI. This is expected to drive credit card adoption, which is among the lowest in major economies around the world. As mentioned previously, India has only 0.05 credit cards per capita, compared to 0.55 in China and 1.1 in USA. This would be a major boost to banks which earn money on credit card fees. ICICI Bank is one of the potential beneficiaries of this development.

Risks

The financial performance of ICICI Bank is invariably tied to the Indian and global economies. Any major slowdown or recession would have a negative impact on the bank’s growth and profitability. While I’m confident in their long-term potential, a dip in revenues or earnings would cause the stock price to fall.

Competition in the banking sector is quite fierce and consumers have many options to send payments, invest or manage their business. ICICI Bank has a strong position on the market but it will have to constantly innovate and invest vast sums into technology to stay ahead of competitors.

Major scandals or corruption issues within the bank would cause a loss of confidence and would negatively impact financial results and stock price performance.

Summary

ICICI Bank is a leading financial services group with terrific management and strong growth prospects. Sandeep Bakhshi has successfully turned the company around, improved employee morale, profitability and quality of the balance sheet. I believe that ICICI can grow its revenues by 15%+ for years to come and earnings even faster, as profit margins expand. The stock is currently selling for less than 20x forward earnings, which is a reasonable price given the quality and growth prospects of the firm.

Leading banks usually maintain an oligopoly and this is likely to be the case in India. ICICI will hold at least the no.2 position among private banks in India for years to come and will grow along its dynamic economy.

Investors can buy a dominant and growing franchise at just 17x 2022 forward earnings. The company also pays a small dividend which is very likely to increase in future years.

https://www.forbesindia.com/article/leadership-awards-2022/how-sandeep-bakhshi-has-quietly-but-firmly-turned-around-icici-bank/74677/1

https://www.financialexpress.com/industry/banking-finance/total-credit-cards-now-at-71-7-m-highest-in-21-months/2472835/

https://www.livemint.com/industry/banking/icici-bank-imobile-pay-2-million-customers-of-other-banks-are-now-using-this-app-11623133089289.html

https://play.google.com/store/apps/details?id=com.csam.icici.bank.imobile&hl=en_IE&gl=US

https://www.thehindubusinessline.com/money-and-banking/cci-approves-merger-of-hdfc-with-hdfc-bank/article65765868.ece

https://www.forbesindia.com/article/take-one-big-story-of-the-day/how-hdfc-banks-litany-of-crises-has-spelt-opportunity-for-icici-bank/68913/1

https://www.spglobal.com/_assets/documents/ratings/research/101563909.pdf

https://fred.stlouisfed.org/series/DDOI01INA156NWDB

https://www.forbes.com/advisor/in/personal-finance/what-is-upi-and-how-does-it-work/

https://www.outlookindia.com/business/linking-credit-cards-to-upi-to-increase-card-usage-in-india-says-goldman-sachs-report-news-201603