Li Auto (LI): The top contender in China's hyper-competitive EV sector

Analysis of LI's competitive situation, valuation and growth prospects

Li Auto’s (LI) stock has done quite well recently, reaching a market cap of $39 billion. They plan to ramp up production to 2 million cars by 2025, from c. 120k cars sold over the past 12 months. The company is doing very well, but the sector is getting crowded so let’s look closer at the business and the whole EV (electric vehicle) industry in China.

LI is a Chinese carmaker which manufactures EREVs, or extended-range electric passenger vehicles. The company was started by Xiang Li in 2015, who also founded Autohome (ATHM), the leading car classifieds site in China worth $5 billion and listed in US. Li also served as a director in Nio (NIO) between 2015-2018.

Historically, LI sold only one model, the “Li One” which is a family SUV with 6 seats, that costs c. 350,000 RMB1 ($52,000). In June this year, they introduced the L9, an improved model that can reach far as 1,315km on a single charge and retails at 459,800 yuan (US$68,654). The company already registered more than 30,000 pre-orders for L9 and Xiang Li expects that deliveries will reach 10,000 units a month by September.

Li Auto has its own manufacturing plant in Changzhou, Jiangsu Province, China. Manufacturing in the factory is highly automated, and features welding, painting and stamping robots, which helps reduce operating costs. They started production of Li One in November 2019, so it’s pretty impressive what they have done in such a short period of time, having sold over 180,000 cars since inception. In October 2021, construction started on a new plant in Beijing that will become operational in 2023.

EREVs are electric cars, that also have a fuel tank which can charge the battery and extend the range. In Li One’s case, the full range can reach over 1,100 km. It has two electric motors, one in the front and one in the back as well as a lithium-ion battery. EREVs are a subset of NEVs (New Energy Vehicles), which mostly consist of BEVs (battery energy vehicles).

Li Auto develops its own hardware and software, similar to other EV car makers. The company’s cars feature a Level 2 autonomous driving software, which was created specifically for Chinese cities. They are also working on Level 4 autonomous driving capabilities, but these still seem far away at this point.

The L9

Here is a recent review of the new model, the car looks really nice and spacious, with 6 seats in total:

Business model

Li Auto differs a bit from other Chinese automakers, as they have a direct sales model. So instead of going through dealers, they own their dealerships with over 247 stores in 113 cities and a further 308 servicing centers and paint shops (June 2022). This is up from 206 retail stores and 278 service and paint centers in Dec 2021. Breadth of the service network is one of the factors, which customers evaluate when buying a car. The closer the service center is to you as a buyer, the better.

This also means they have better control over their brand, pricing and servicing. The company claims that this model is more efficient and allows them to save on costs.

As a result, Li Auto expanded more slowly than other EV car makers in China. The company had to build its dealerships and service centers and expand city by city, which takes a lot of time and capital.

Tesla actually has the same model and owns its dealership network.

Li Auto also offers an annual subscription at 999 RMB, which features better after-sale service, paid regular servicing of the vehicle, free vehicle pick-ups and deliveries, unlimited high-speed data plan, and other discounts on services and products. The revenue from this stream is negligible at this point.

The company also earns revenue from selling Automotive Regulatory Credits, which they receive from the government as a result of manufacturing EVs.

The company focuses its marketing efforts on creating short videos on platforms like Kuaishou or Douyin. Despite having only one model until now, the brand has become quite popular with China’s middle class families and they have also grown through word-of-mouth referrals. During 2021, LI spent just $164 million on marketing, which is a tiny sum compared to legacy automotive companies.

Chinese electric car market

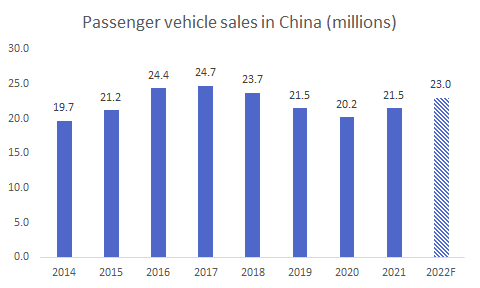

Last year, there were 21.5 million passenger cars sold in China, as the market grew 6.5% after 3 years of declines. Out of those, 3.3 million were NEVs, or electric cars2 (15.3% market share). This year, the figure is expected to jump to 5.5 million, which would be c. 24% of all passenger cars sold in the country3.

Despite impressive progress, EVs in China made up just 3% of the total passenger car fleet4, which is expected to increase to 30% by 2030 and 77% by 2040. China has more than 300 million cars on its roads, so it will take many years before the whole fleet is replaced with new energy vehicles. As a result, Li Auto and other electric automakers have a very long runway ahead of them, which is why investors are so bullish about the sector.

Last year, there were more than 300 EV makers in China5. Foreign brands have historically dominated the market with market shares of 60-70% over the past few years. This has now dropped to 42% in April 2022 according to Reuters6, and will probably decline further. Chinese companies are producing high quality and competitive cars, with lots software and smartphone-like features embedded in them.

Volkswagen, one of the largest automakers in the world fell short of 80,000-100,000 EVs sold in China last year. The company plans to produce at least 1 million EVs in the country by 2026, but so far they haven’t gained much traction.

Chinese brands have a local advantage and understand the customer much better. For example, the traffic is so congested in some large cities, that you rarely drive faster than 60/kmh and you don’t need many of the fancy features for highway driving or top speed. The quality of domestically-produced cars has changed dramatically, and Chinese companies could even start taking market share abroad.

Li Auto mainly competes with the likes of Tesla, BMW and Audi, as well as local players Nio, Xpeng, BYD and others. Tech companies such as Xiaomi have also announced their entry into the sector. Here is a snapshot of some of the leading car models in the SUV category.

The prices in the table are very indicative, the models have various features, ranges, sizes and so on. It’s hard to compare them head to head. But it tells us that Li L9 is priced somewhere between the BMWs and Teslas and and BYD at the bottom of the range. So it’s an affordable and spacious car for the Chinese middle class.

This also shows how much competition there is in the Chinese EV market. These models are just the top brands, but there are plenty of others from local car makers that compete with Li One and L9.

Main competitors

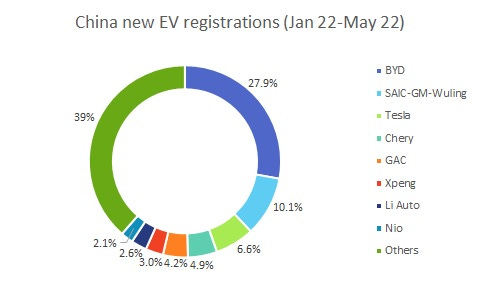

According to Inside EVs7, there were 1.8 million new electric cars registered in China from January to May this year. Around 400,000 of those were sold in May alone, representing 31% of new car registrations.

The 10 best-selling models were:

Wuling Hong Guang MINI EV - 161,579

BYD Song (BEV + PHEV) - 127,304

BYD Qin Plus (BEV + PHEV) - 109,229

Tesla Model Y - 81,125

BYD Han (BEV + PHEV) - 71,786

BYD Dolphin - 48,138

BYD Tang (BEV + PHEV) - 47,691

Li Xiang One EREV - 47,380

Chery QQ Ice Cream - 44,434

Changan Benni EV - 41,298

All of these except for Tesla are local brands, with Li Auto occupying the 8th place. Xpeng actually sold more cars than LI, but they have more models and none of them landed in the top 10. Below is the estimated market share of EV brands in China based on YTD numbers up to May (c. 1.8m):

BYD is clearly the market leader (28% market share), with no other brand coming even close. They sold almost 3-times as much as their second closest competitor, SAIC-GM-Wuling (join venture). And SGMW numbers are in large part influenced by the Hong Guang Mini EV, which is the cheapest EV in China.

Based on these figues, Li Auto has a roughly 2.6% market share in the country, ahead of Nio but behind Xpeng based on the no. of cars sold. EVs represent just 31% of new cars sold in China, so Li Auto’s actual market share of new cars sold is less than 1%.

On one hand, this means tremendous potential for further growth. Gasoline cars will probably be fully replaced by electric vehicles in the coming years. On other hand, there are so many competitors that it will be very difficult to earn high returns on capital for all the participants. Li Auto will have to differentiate by either becoming the low cost producer, or offering unique services or technology that give them an edge.

LI, XPEV and NIO had a similar starting point in terms of deliveries. Nio leapfrogged both of their competitors in 2020, but fell behind by late 2021. That’s despite the fact that Nio was less hurt by the lockdowns in Shanghai than Both Xpeng and Li.

All 3 have announced new models this year, along with other automakers. The space is becoming really crowded, with dozens of models available.

Li Auto plans to sell 2 million cars in China by 2025 (20% market share), a very ambitious target8. The company is talking directly with chip makers such as Infineon or NXP Semiconductors to shore up supply chains and remove any bottlenecks in advance. The investment services firm Morningstar is less optimistic and expects Li Auto to hit c. 500,000 deliveries in 2025, roughly a quarter of their target. This would still be four times the amount they delivered over the past 12 months. So far they plan to focus on the domestic market, unlike other Chinese automakers that are targeting US or Europe.

The company expects to offer models in the price range between $30,000 and $74,000 (200,000 to 500,000 RMB), with both BEVs and EREVs under development.

Financials

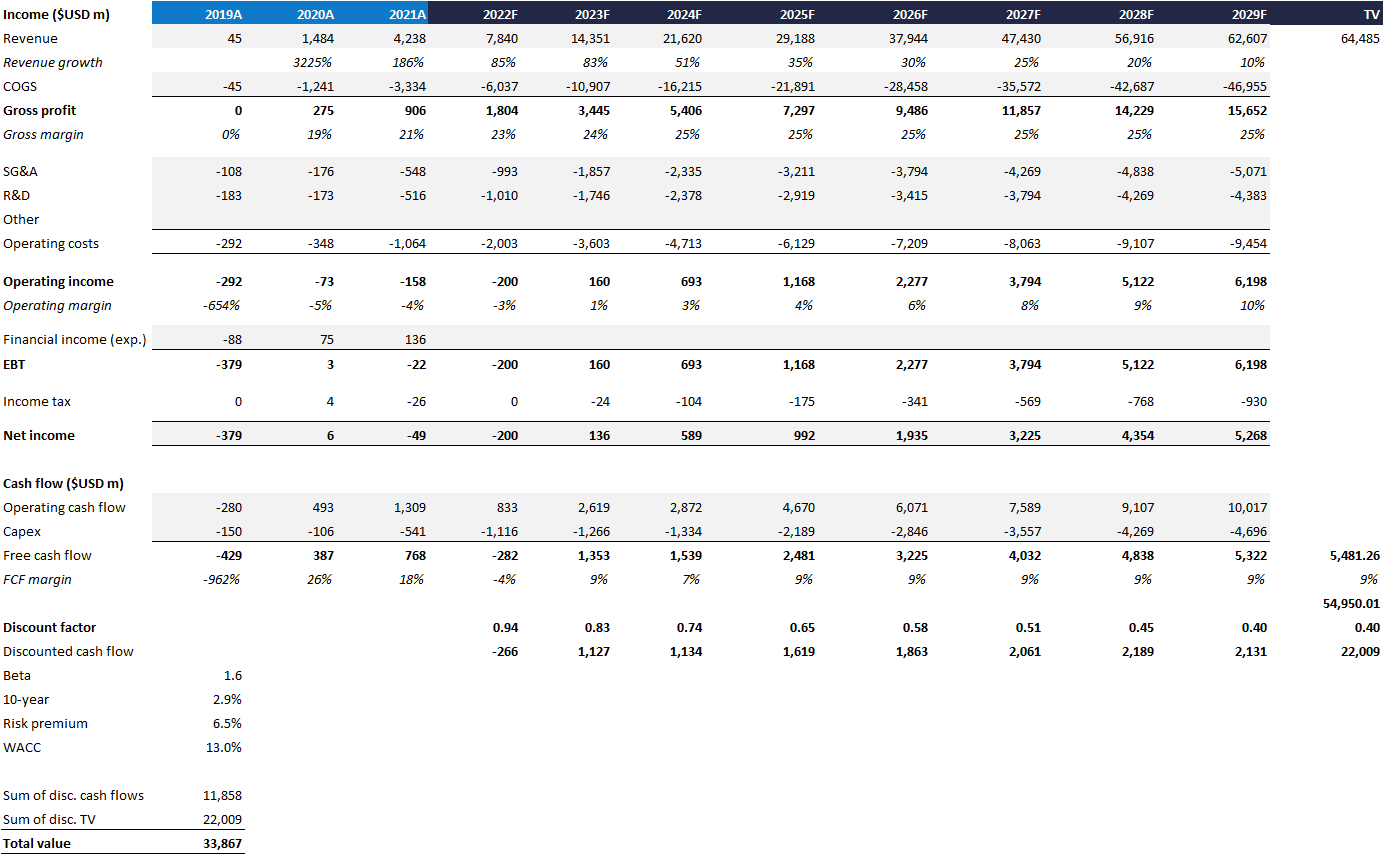

Revenue has grown from just 284 million RMB in 2019 to 27 billion ($4.2bn) by 2021. They are forecast to reach 53 billion ($7.8bn) this year and 96 billion ($14.3bn) in 2023. The company is expected to hit an operating margin of c.1% in 2023, or 1.1 billion RMB ($160m).

Sell-side analysts are predicting strong growth in the years ahead and climbing deliveries for their L9 model. Expectations are certainly high and Li Auto is no under-the-radar stock.

Li Auto is way more profitable than Nio (NIO) or Xpeng (XPEV), but its profitability is still behind Tesla. Tesla has a lead of many years, and it will be hard for the Chinese firms to catch up, despite their impressive progress up to this point.

LI has a negative operating margin, however its EBT margin is positive, thanks to interest income on their cash balances and other income. So far, LI appears to be among the low cost leaders, as their gross margins are significantly above Xpeng or Nio.

Q1 2022 Operating cash flow was a positive $289 million, which is great. They had capex of $210 million, which translates to free cash flow of $79 million. Both Nio and Xpeng do not provide information regarding their quarterly cash flow.

Li Auto generated 4.9 billion RMB in free cash flow during 2021 ($728m) which is quite impressive. This was driven mainly by an increase in trade payables, as the company probably maintains lengthy payment terms with suppliers.

The company has $10.4 billion in assets, out of which $7.6 billion is in cash (excl. restricted). Li Auto is clearly not reliant on any outside financing anymore and has plenty of funds to finance their expansion. Nevertheless, last month they announced plans to raise $2 billion through the sale of ADRs after the recent jump in LI’s stock price.

SG&A expenses include salaries for non-R&D staff, marketing costs, rents, depreciation and other expenses. Li spent 1.1 billion RMB or $164m on marketing during 2021. That’s a bit lower than Nio, which spent 1.4 billion RMB. Tesla has famously spent almost nothing on marketing, growing through word-of-mouth referrals and Elon Musk’s advertising skills.

The company used to be eligible for government subsidies but the legislation went through various changes in recent years. Subsidies are now only for car models that cost less than 300,000 RMB, as a result Li Auto’s models no longer qualify for these.

Li Auto Management and Shareholders

Li Xiang doesn’t provide many interviews but here is a short video about his entrepreneurial career:

Li Xiang founded PCPOP.com and later Autohome, which became a multi-billion dollar company. Li was approached by the founder of Nio, Li Bin, to become a partner in the business.9 Xiang turned him down, however he invested $15 million in Nio at an early stage and became a board member at the company.

Li Auto initially focused on developing small electric cars, but they dropped the effort and focused on SUVs instead.

Li Xiang owns 23% of the company along with 70% voting power. Another 19% is owned by Wang Xing, the founder of Meituan. Institutional investors in LI include Tiger Global, Baillie Gifford or Viking Global Investors.

How much is Li Auto worth?

It’s a tough challenge to value fast growing companies. The EV market in China is hyper-competitive, with lots of new players still emerging and long-term margins unclear. I have used the sell-side estimates presented above as a base case scenario. In my valuation analysis, I am assuming LI hits $14.3 billion in revenue by 2023 and $29 billion in 2025. Using an average sales price of $60,000 USD, that would imply they sell roughly 484,000 cars in 2025, similar to Morningstar’s projection.

Analysts are expecting Li Auto to be profitable on an operating income basis by 2023. Free cash flow is projected to hit $1.35bn and $1.54bn in 2023 and 2024, respectively. Cash flow is significantly above operating income or net income, this is usually temporary. The company is taking in deposits for new cars and perhaps has generous payment terms with suppliers, which means they have negative working capital and can reinvest the extra cash back into the business. Over the long run, free cash flow should be pretty close to net income.

The first 3 years of the forecast are taken from sell-side estimates (Capital IQ) and then extrapolated further, using declining growth rates, gross margins of 25% and FCF margins of close to 9%. These are all just assumptions, as no one knows how profitable will electric cars ultimately be. Both margins levels are above those achieved by leading car makers such as Toyota or Volkswagen over the past 10 years.

Using a WACC (Weighted average cost of capital) of 13%, I am getting a net present value of $34 billion, close to LI’s current enterprise value. I think the assumptions above are quite aggressive, with revenue rising 15-fold over the next 8 years, in a very competitive space.

In order to buy the stock, I’d have to believe that they will grow even faster than that or achieve much higher margins. The company will very probably grow outside of China, as the quality of its cars seems comparable or even better in some aspects than international models.

LI’s current market cap is $39.1 billion, and an enterprise value of $32.9 billion thanks to large cash balances and low debt. The stock trades at a forward 2022 EV/Sales ratio 4.2, or 2.3 using 2023 revenue numbers.

Based on 2022 forward EV/Sales, it’s slightly more expensive than both XPEV (3.9) and NIO (3.55), thanks to higher profitability. All of them are selling at a deep discount to TSLA, due to the recent slide in Chinese stocks, potential regulatory issues and lower trust in Chinese accounting figures and financial reports.

If LI really hits 500,000 cars annually by 2025 and $29 billion in revenue, using a forward EV/Sales multiple of 3 (similar to BYD) would give us an EV of $87 billion (by 2025). That would imply a stock price CAGR of 32% (assuming no dilution), which would be a very solid return. However, it all depends on the margins of EV companies in the future.

The sector is rapidly evolving and the profitability of leading companies will likely be very different from the legacy manufacturers. Electric cars have a significant software component, which is a potentially big earnings stream for producers. That’s probably the reason why Apple wants to enter the space, as the time spent in the car will divert attention from smartphones to the entertainment provided by individual models.

Conclusion

Li Auto is growing rapidly and has a lot of runway ahead of it to expand further. However, I don’t see a big margin of safety there. It’s really hard to predict who will emerge victorous from the many contenders. Right now, I don’t see LI as having a distinguishable competitive advantage from the others. Maybe that’s because I don’t have enough local knowledge and can’t compare the different brands, their customer service or software offering. As a result, I’m happy to sit on the sidelines on this one, and see how it develops. Someone with more knowledge might find it a much better opportunity, but right now

Li Auto’s stock is one of those situations, where you might put a few percent of your portfolio in it, in case they really succeed and become one of the top 3 automakers. However I wouldn’t make it a large position as there are so many risks around their future growth path.

As Warren Buffett said many times, there were hundreds of car manufacturers in America in the early 20th century, and only 3 of them survived.

LI is having great success with its Li One (and L9 pre-orders so far) and hopefully they will be able to build on that and release more. If you believe that the company can grow much faster and capture a larger share of the global EV market, then it might be worth buying the stock. I feel like I can’t really tell who will win the race ultimately, so I’ll just put this in the “too hard” pile and look for other opportunities.

https://cnevpost.com/2022/03/23/li-auto-raises-price-of-li-one/

https://www.electrive.com/2022/01/11/china-counts-more-than-3-million-nev-sales-in-2021/

https://www.reuters.com/article/china-autos-idAFL1N2YS0BY

https://www.wired.com/story/china-ev-infrastructure-charging/

https://fortune.com/2021/09/13/china-electric-vehicle-ev-market-consolidation-byd-nio-xpeng/

https://www.reuters.com/business/autos-transportation/global-automakers-face-electric-shock-china-2022-05-25/

https://insideevs.com/news/594260/china-plugin-car-sales-may-2022/

https://www.bnnbloomberg.ca/li-auto-s-heady-ev-sales-target-rests-on-winning-over-chipmakers-1.1791624

https://kr-asia.com/meet-chinas-elon-musk-li-xiang-founder-of-recently-us-listed-ev-maker-li-auto