Nubank (NU) deep dive: World's largest digital bank

Nubank could potentially hit $10 billion in revenue by 2026

Nubank shares could offer 25% CAGR over the next 5 years

Strong moat and hard to replicate business

Low-cost leader in the banking sector

Huge and expanding addressable market

Nubank (NU) was founded in 2013 and initially started with a simple credit card product.

Today, Nubank is a full-fledged digital bank (neobank) that serves 48 million customers in Brazil, Mexico, Colombia. For consumers, it offers:

Deposit accounts

Credit cards, debit cards

Mobile payments - including Whatsapp, PIX and QR code payments

Personal loans and Buy Now Pay Later options

Life insurance

Investments

More than 1.1 million SMEs have a business account at Nubank, utilizing loans, credit cards or just regular deposits.

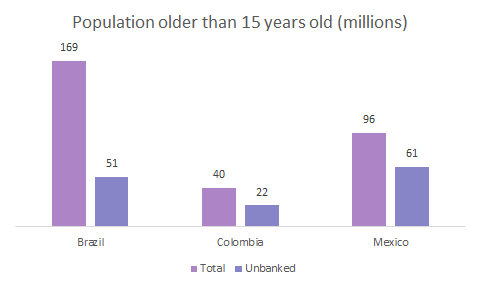

Nubank is still very early in its journey, as there are tens of millions of people in Latin America that still don’t have a bank.

Strong brand

Nubank has been named the no.1 brand in Brazil by eCGlobal and one of the most influential companies in the world by TIME mgazine.

According to their estimates, 80-90% of customers are acquired organically through word-of-mouth referrals. This is an incredible number and drastically lowers the customer cost of acquisition. Money can then be reinvested into broadening their product portfolio or improving digital solutions.

Their NPS (Net Promoter Score) is 90 in Brazil and 94 in Mexico, way above competitors.1

Growth potential

A significant share of the young population in Latin American countries is unbanked and have very limited access to financial servies.

In fact out of 750 million people in Latin America, 250 million don’t have a bank account.2

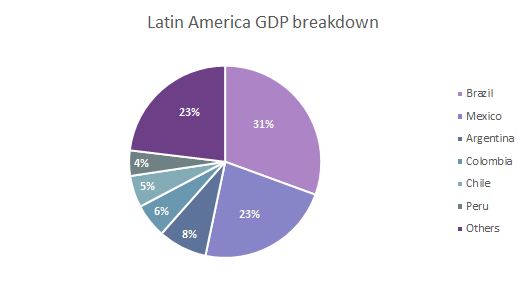

Latin America has an estimated GDP of $4.7 trillion according to WB3. Brazil and Mexico represent more than half of that.

Based on S&P Global forecasts, Brazil, Mexico and Colombia are expected to grow their GDP by 2-3% per year until 2024.4

The F-1 filing mentions an addressable market of $99 billion in 2020 based on their current services. This is expected to grow to $126 billion or 5% CAGR until 2025. Based on ttm revenue of $1.3 billion, this is just 1.3% market share with plenty of growth ahead.

Based on an Oliver Wyman report mentioned in the IPO documents, fintechs and digital banks in Brazil are responsible for 4.6% in retail credit outstanding (up from 2% in 2017).

In Brazil, both consumers and businesses pay extremely high interest rates for loans5. This is stifling the economy, and by lowering the cost, neobanks like Nubank actually help accelerate Brazil’s growth.

Nubank’s co-founder David Vélez also mentions in a recent interview, that 40% of consumers in Brazil are blacklisted by the consumer bureaus and are outside the credit system. Which means the large banks won’t lend to them, and they will pay significantly higher rates through the shadow banking system than those presented above.

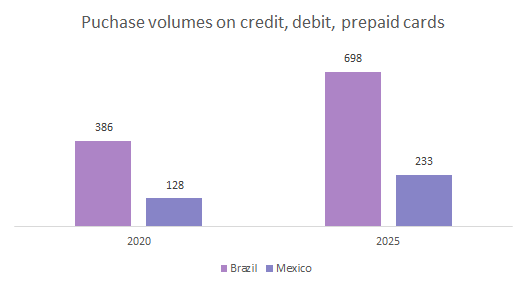

The total purchase volume on credit, debit and prepaid cards in Mexico and Brazil is expected to jump 80% between 2020 and 2025. This roughly translates to 13% CAGR in both countries, a favourable trend for Nubank and other lenders in the region.

The same report mentions, that the share of retail investment assets at large banks went down from 93% in 2018 to 81% in 2020.

So all stars are aligned for Nubank to grow further and capture market share from incumbents.

The switch to digital banking in Latin America has just started and will take many years.

Nubank can grow by capturing a larger share of customers wallets and cross-selling additional products.

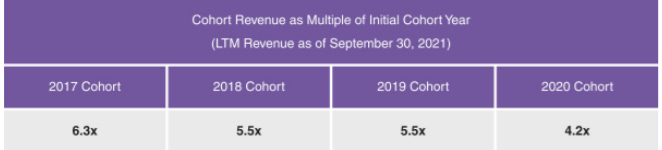

Customers gradually expand their spending with Nubank, and for exmaple the 2017 Cohort generates 6.3x more revenue in 2021 than 4 years before.

Nubank opportunity

Highly concentrated banking sector. The banking sector in Latin America is highly concentrated, with incumbents controlling 70-85% of market share.

As a result, there has been little innovation in the space, as banks enjoy their oligopoly position and see no reasons to improve.

High cost to serve. Incumbent cost structures are very different from Nubank, physical branches and tens of thousands of employees mean fees have to be kept high to keep the machine going.

Bad customer service. Nubank receives 269 per 1 million customers, compared to median of 1,416 at competitors. Their focus on customer experience and resulting high NPS certainly help.

Nubank also expanded into insurance, which is still underpenetrated in Latin America. The Brazilian insurance sector has the potential to triple its size in the coming years, bringing additional revenue to Nubank6.

Business model

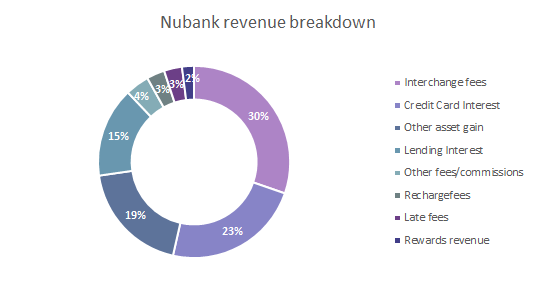

Nubank generates revenue from various fees, but the most important are interchange fees.

Interchange fees are charged based on the volume that customers spend on credit or debit cards. Average net take rate for NU is currently 1.1%.

Second most important revenue source is credit card and loan interest.

As you can see, the revenue structure is not different from a traditional bank. The main difference is, that Nubank charges significantly lower fees compared to competition and is a digital bank with much lower fixed costs (no physical branches).

This is the source of their competitive advantage.

Itaú, the biggest bank in Brazil, has 50 million customers and they have 120,000 employees. Nubank has only 5,400 employees and a similar number of customers.

Customer acquisition

David Vélez, the co-founder explained their advantage in Patrick O'shaughnessy’s podcast.7 They charged nothing for many of Nubank’s services, which helped them attract customers essentially for free.

Nubank also has a large presence on social media with more than 10 million followers across various channels. Nubank posts a lot of content related to financial education and has a large user forum called NuCommunity.

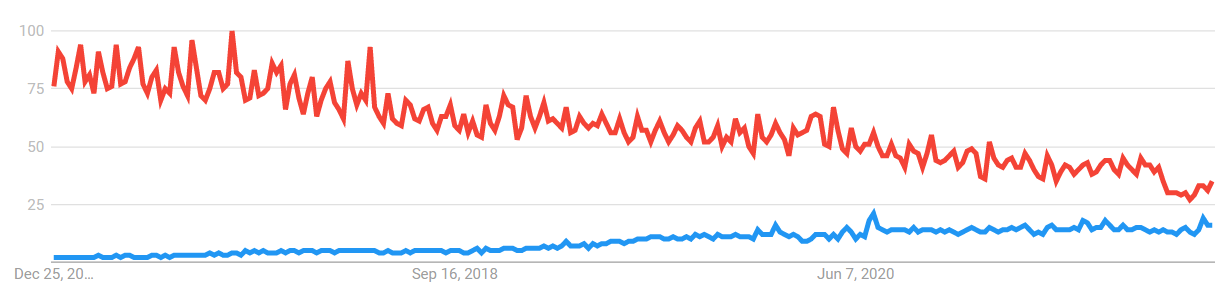

This helps them get organic traffic from search engines, reducing CAC (customer acquisition cost) even further.8 Below is a chart comparing Google Trends volume of searches for “Nubank” (blue line) and “Banco Itaú” (red).

Nubank tracks the underlying profitability of its business through contribution margin. It’s the sum of revenue from credit card, personal lending and NuAccount products, less variable expenses (interest and other financial expenses, transactional expenses and credit loss allowance expenses) directly associated with this revenue.

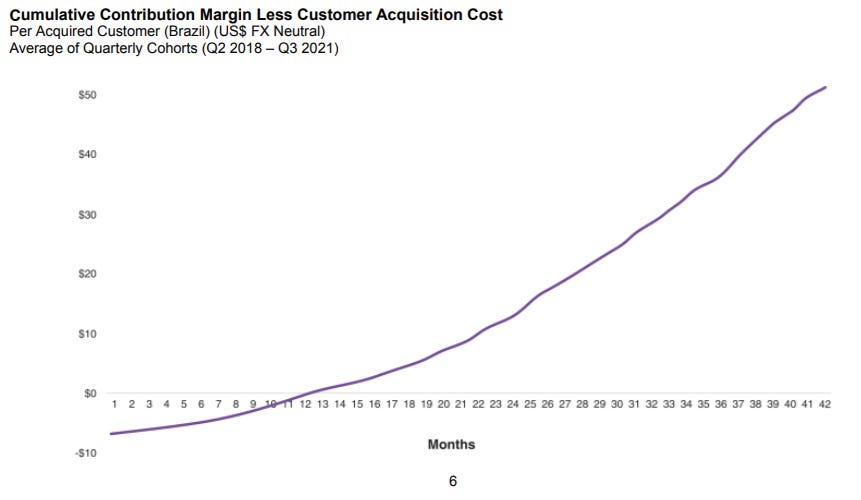

Customer acquisition costs are printing and shipping of cards, credit data costs (credit bureau costs) and paid marketing.

So generally, it takes 12 months in order for a customer to become profitable for the bank. Banks are notorious for their stickiness, so once a customer creates an account, he or she is very likely to stay for many years and keep generating revenue for Nubank.

Nubank’s LTV/CAC ratio is more than 30x, according to IPO documents. This is really crazy high and just shows how low their CAC actually is and how profitable those customers are even at lower fees.

Nubank tracks a metric called Monthly ARPAC (average revenue per active customer), which has reached $4.9 by September 2021. The company calculates, that the cost of customer acqusition is just $5, one of the lowest costs among any fintech globally.

Basically the bank acquires a customer for $5, it takes up to a year for that customer to be profitable. After 24-36 months, the customer has generated $15-$30 in contribution profit, which is likely to rise to $50 by the 42nd month.

Voluntary customer churn for the first 9 months of 2021 is only 0.06% per month, which implies that customers could stay for dozens of years. Churn was much higher at 0.5% during 2020.

These are very impressive economics and there is no wonder why Berkshire was interested in investing.

Financials

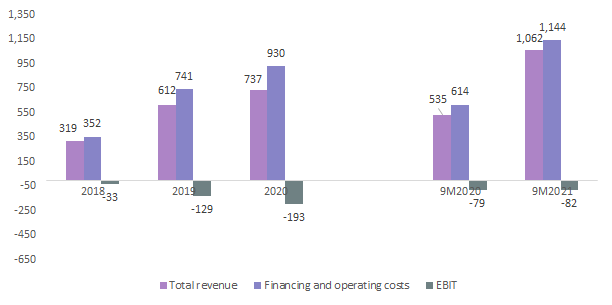

Nubank has generated $1.1 billion in revenue in the first 9 months of 2021, with an operating loss of $82 million. The bank is still losing money on an accounting basis, however it makes perfect sense for them to keep investing into infrastructure, marketing and customer support as the LTV/CAC ratio is really high.

Revenue jumped almost 100% in the first 9 months of 2021, but that was after just 20% growth in 2020. COVID-19 has hit the Brazilian economy very hard, with banks tightening credit (including Nubank) and consumers spending less on their credit cards.

It was exactly the credit card spend decrease that translated into lower revenue growth for Nubank. This started to reverse in 2021 and they are growing at a healthy clip now.

The bank has $15 billion in assets and $1.9 billion in equity. This translates to an equity/assets ratio of 12.6%, pretty much in-line with larger US banks.

Most of their assets are composed of securities such as treasury bills and government securities ($4.7 billion) and credit card receivables ($4 billion). The company also holds $2 billion in cash and cash equivalents.

Liabilities are mostly composed of deposits ($8.1 billion) and payables to credit card networks ($4.1 billion).

Warren Buffett always mentions, that banks usually get in trouble on the asset side of the balance sheet. They expand the loan book too fast and lower underwriting standards. Nubank has a pristine balance sheet and assets are mostly placed in very liquid instruments.

Competitive advantage

Nubank has a huge first mover advantage, as it was the first digital bank in Latin America to reach significant scale.

They entered Mexico in early 2020 and already became the largest credit card issuer in the country.

The Brazilian banking sector is extremely profitable even compared to global peers. During 2019, local banks earned 17% returns on equity, compared to 11% in US or 6% in Europe, according to FT.

But incumbents are not asleep either. They are investing heavily into technology, lowering fees and closing branches to optimize their cost structures.

Banco Bradesco has launched its own digital bank called Next, which has drastically lower fees and over 4 million users.

However, it’s extremely difficult to turn a large ship around. Large banks just can’t fire tens of thousands of employees. They are also hampered by technology. Many of them still use legacy systems and databases, including the programming language Cobol. Any updates they make to their software take a long time.

Nubank has a significant advantage, as it was built from the ground up as a digital bank using modern technology. They have millions of data points on their customers, which can be used along with AI and machine learning to improve the onboarding process, overall experience, launch new products or in general decision making.

Large banks usually use disparate technology systems and data is siloed across departments, crippling the ability to use it at scale.

Customer support is a differentiating factor for Nubank. They use automated self-service support tools and a trained team of employees (Xpeers), which help customers with their issues. In fact, almost 40% of employees work in customer support.

Nubank has built a very defensible and difficult-to replicate business. All neobanks that are entering now primarily compete primarily with Nubank, and not with the legacy banks. As a result, the bar for low friction, great customer support and experience and low fees has been moved higher.

Nubank can already spread their fixed costs among a base of 48 million customers, which gives them huge scale advantage compared to late entrants.

Financial regulation is another obstacle for small fintechs. As the saying goes, regulation protects incumbents, not upstarts.

As a result, I think the threat of new entrants is low and the barriers to entry remain extremely high for any neobank startup in Brazil.

In an effort to increase competition and lower fees in the banking system, the central bank unveiled PIX, a payment system that is free for individuals.

Management & Shareholders

Nubank was founded by David Vélez, Cristina Junqueira and Edward Wible. Vélez actually worked at Sequoia Capital in their Brazilian office. He was tasked with finding interesting technology firms in the country, but decided to build his own.9 He previously worked at Morgan Stanley and General Atlantic, so he is primarily a finance guy.

The beginnings were extremely difficult and the company almost went bust several times due to regulation and new banking laws.

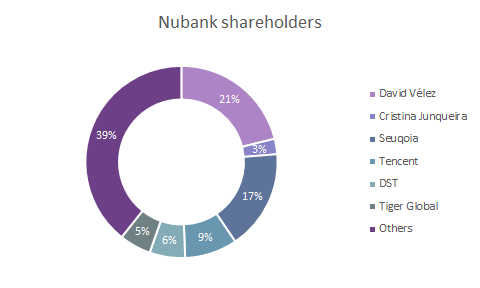

David Vélez has 75% of the voting power in the company, with Cristina Junqueira owning another 9.3%. Vélez owns 21% of shares in Nubank, which makes him the largest shareholder. Other investors include Sequoia Capital, DST Global, Tencent and Tiger Global. Berkshire Hathaway invested $500 million at a $30 billion valuation10, and reportedly purchased 10% of the shares that were floated in IPO. The exact number is not known, so they are grouped under “Others”.

Based on the F-1 filing, 76% of employees own shares in Nubank. Employees with shareholdings are usually more incentivized to deliver great performance.

Valuation

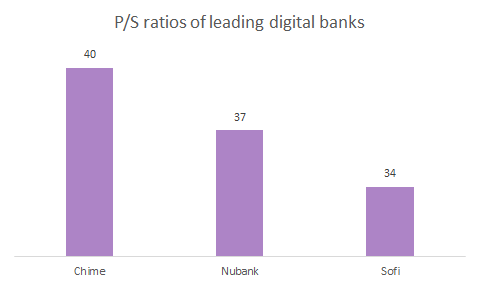

Large Brazilian banks currently trade for around 0.5-3x sales, a steep discount to their historical average and to Nubank. NU has a P/S ratio of 37, comparable to other digital banks such as Chime or Sofi.

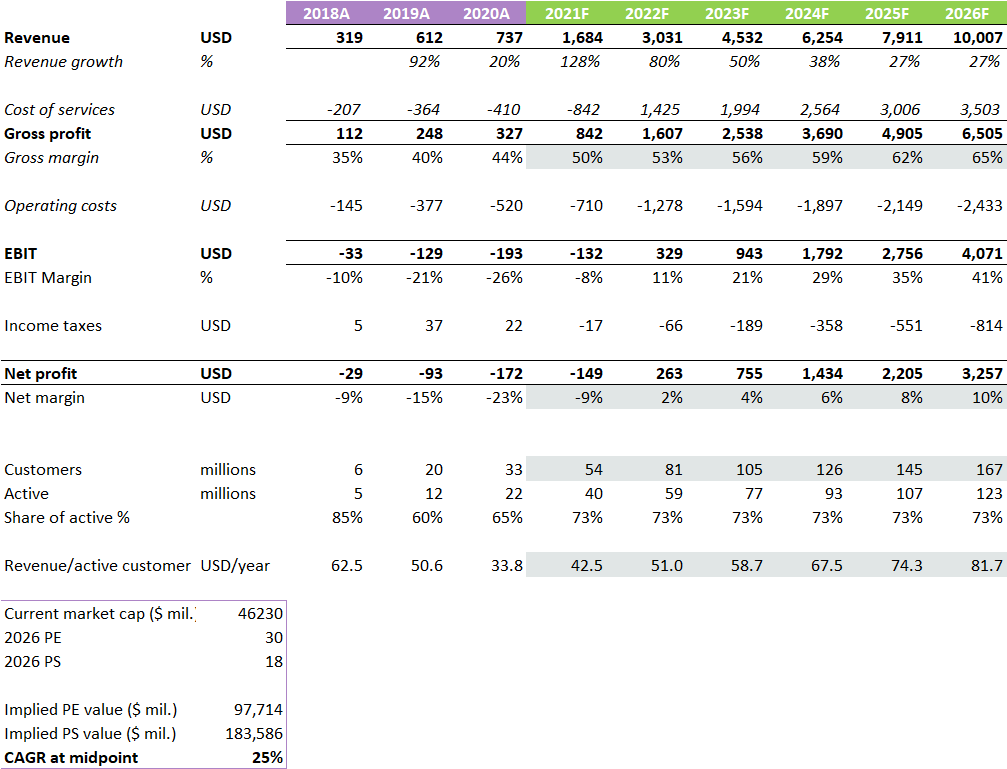

I have built a simplified P&L forecast for Nubank. I have deliberately used more aggressive assumptions, to see what the upside would be from current prices.

Assuming the bank keeps growing at a fast clip (80% in 2022 and 50% in 2023), they could potentially reach $10 billion in revenue by 2026. I’m also assuming that average revenue per active customer would grow by double digits over the next 5 years.

Active customers would hit 123 million by 2026, or more than 20% of Latin America’s population. Like I said, the assumptions are aggressive.

I arrived at an estimated valued of $140-$180 billion by 2026. This would represent a 5-year CAGR of at least 25% from current prices.

I have used S&P Capital IQ for 2021 and 2022 revenue and EBIT forecasts. Other numbers are my own calculations.

Nubank still offers a very interesting opportunity even at today’s valuations. The forecasted user numbers might not be crazy after all, as Softbank expects them to reach at least 100-150 million users in the next 5 years.

Competition

There are still major players in Brazil or Mexico that could pose a threat to Nubank. One of them is XP Inc., a major investment brokerage that recently entered the banking business11.

JPMorgan has bought a 40% stake in C612, a Brazilian digital bank that was last valued at $5 billion.

Another digital bank is PagBank, the banking arm of payment processor PagSeguro. The company has 12 million clients, and is growing very fast based on their investor presentation.

So there is plenty of competition just like in any other business. But Nubank is the clear leader in terms of innovation and number of clients, while others are mostly mimicking their moves.

Risks

The main risks are:

Currency risks in countries they operate

Interest rate risk

Sensitivity to the Brazilian economy

Incumbents digitizing their offerings

New entrants

Valuation multiple compression

Nubank is still a bank at its core. It has manage its assets and liabilities wisely, to avoid too risky loans that could impair their balance sheet. In fact, the bank has been in crisis mode since inception, as Brazil’s economy has struggled for the past 7 years.

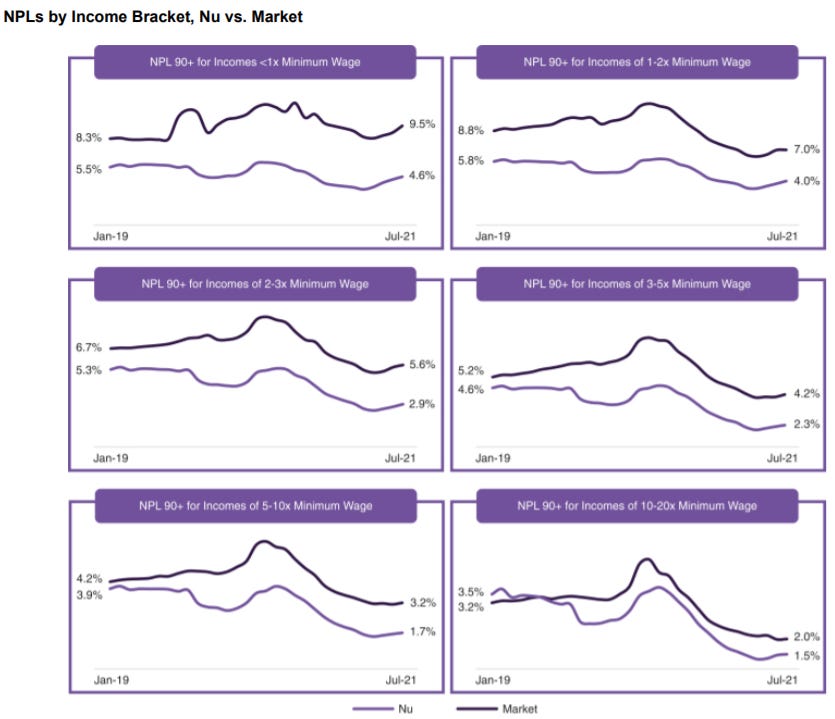

NPLs (non-performing loans) are way below market levels. Roughly 10% of borrowers with incomes below the minimum wage are in default across Brazil, compared to 4.6% in Nubank’s portfolio. Their NPLs are very low and haven’t spiked despite a raging pandemic in Latin America.

NU is still very sensitive to the economic situation in Brazil. The slowdown from COVID-19 in first half of 2020 is pretty visible in the results. If another major recession hits, Nubank will probably still grow but at a much slower pace. That could cause a compression in the valuation multiples.

The vast majority of revenue is in local currencies, which presents another investment risk. The Brazilian real has depreciated by more than 40% against the dollar since 2016. If Nubank’s revenues rise by 100% but the currency depreciates by 50%, public shareholders won’t gain anything.

Conclusion

Nubank is a great company with a clear value proposition. They have the best product on the market, that is allowing millions of people to access basic financial services. The target market is huge and expanding.

Nubank stock is not an undiscovered gem. Many investors realize the quality and large moat of the business, which means it’s already partially reflected in the valuation.

If management continues its excellent execution, NU stock will be worth multiples of its current price in a few years. Any hiccups or slowdown in the growth rate would cause a big drop in multiples and stock price. There isn’t much of a margin of safety present, execution must be excellent.

These could provide an interesting opportunity to accumulate shares in the future.

I will start a medium sized position in the stock and see how the business develops over the next few years..

https://api.mziq.com/mzfilemanager/v2/d/59a081d2-0d63-4bb5-b786-4c07ae26bc74/c3d805db-1757-55a0-d8a3-44391b42b501?origin=1

https://www.joincolossus.com/episodes/16951337/velez-building-the-branchless-bank?tab=transcript

https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?locations=ZJ

https://www.spglobal.com/ratings/en/research/articles/210927-economic-outlook-latin-america-q4-2021-settling-into-the-new-post-pandemic-normal-of-slow-growth-12122907

https://www.bcb.gov.br/en/statistics/monetarycreditstatistics

https://noticias.mapfre.com/en/antonio-huertas-interview-valor-economico-brazil/

https://www.joincolossus.com/episodes/16951337/velez-building-the-branchless-bank?tab=transcript

https://trends.google.com/trends/explore?date=today%205-y&geo=BR&q=nubank,%2Fm%2F04qmk7

https://www.joincolossus.com/episodes/16951337/velez-building-the-branchless-bank?tab=transcript

https://finance.yahoo.com/news/brazil-nubank-jumps-debut-raising-182040590.html

https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/brazil-s-xp-takes-its-fight-with-banks-to-the-500b-reais-loan-market-65178911?utm_medium=website&utm_source=digitalnewsletter&utm_content=theinsightweeklydigital07.05

https://www.ft.com/content/2caae530-49b7-4059-80bf-5b78205f4c31