Samsara S-1 breakdown: Data analytics for the physical world

A summarized version of Samsara's IPO prospectus

S-1 Highlights1:

$493m Q3 ARR (annual recurring revenue)

Q3 gross margin of 72%

more than 25,000 customers (13,000 generate more than $5,000 in ARR)

Q3 revenue of $114m (up 73%), net loss of $32m

10% of ARR comes from outside United States

Retention rate of 115% at the end of October 2021

Business overview

Samsara was founded in 2015 and is solving the problem of opaque operations and disconnected systems at “physical” locations and assets of companies. By utilizing signifcant advancements in IoT connectivity, artificial intelligence (AI), cloud computing and video imagery, they are enabling the digital transformation of physical assets.

The company consolidates data from IoT (Internet of Things) devices and a growing ecosystem of connected assets and third-party systems, and makes it easy for organizations to access, analyze and act on data insights. All of it is uploaded into the cloud and accessible in real-time through their apps.

In other words, Samsara helps companies digitize their assets by either connecting them to the internet or integrating with existing vendors (through APIs) and aggregating all data in one place. This helps them provide actionable insights.2 They collect more than 2 trillion data points annually, including video footage, people and motion detection, GPS location, energy consumption, asset utilization, compliance logs, accelerometer and gyroscope data, and engine diagnostics.

Their most important verticals are Transportation, Wholesale & Retail and Construction.

Connected Operations cloud includes video-based safety, vehicle telematics, apps and driver workflows, equipment monitoring, and site visibility. The subscriptions are priceed on a per asset, per application basis. For example, one vehicle using two Applications (video-based safety and vehicle telematics) would count as two subscriptions. A five-building site with each building having one piece of equipment and using two Applications (equipment monitoring and site visibility) would count as ten subscriptions.

Customers can either use IoT devices developed by Samsara, or connect their own to Samsara’s cloud application. Samsara’s devices are designed to be able to deliver data even in remote locations or low power settings. The company outsources the manufacturing of these devices to Taiwan.

Benefits of using Samsara software:

higher utilization of physical assets

reduced need for manual oversight and judgment

improved safety outcomes

lower insurance costs

fuel and electricity savings

emissions reductions

less unplanned downtime

efficiencies from routing and scheduling

minimized compliance costs, and

automation of manual processes.

The company sells the software subscription to small businesses, state and local governments, and global enterprises. Approx. 98% of their revenue comes from Connected Operations Cloud subscriptions, with the rest coming from sales of equipment.

Samsara offers a variety of different applications that are part of the Connected Cloud, and 52% of customers use more than one application. Two applications, Video-based Safety and Vehicle Telematics represented $200 million of ARR at the end of October 2021 (41% of total).

The company enjoys certain network effects: The more customers that use their product, the more data they collect and the better their machine learning algos become.

Subscription contracts are usually 3-5 years and noncancellable.

Financials

The company has grown ARR every quarter for at least the past 11 quarters.

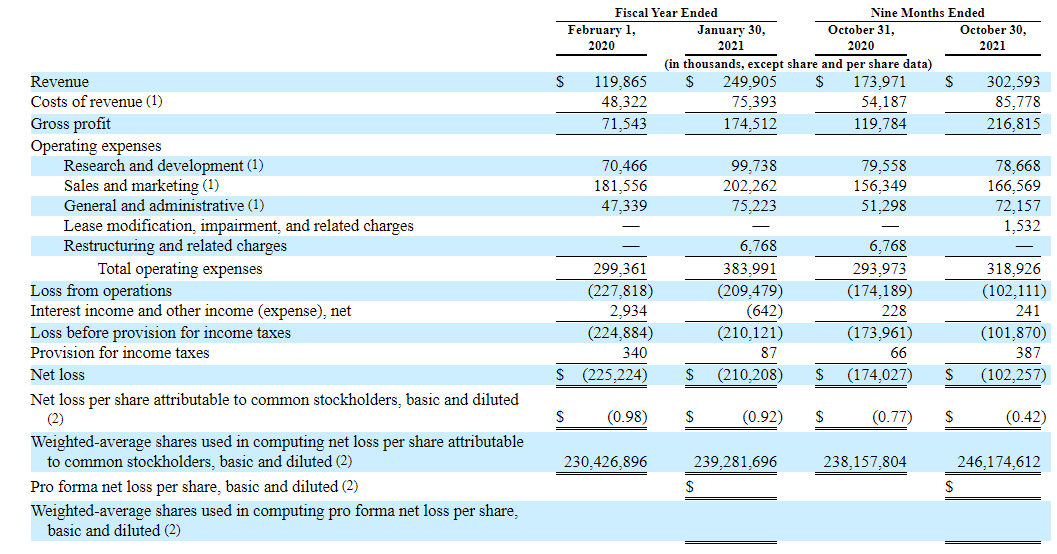

Revenue reached $302m over the 9 months ending Oct 2021 (up 74% yoy). The company recognized an operating loss of $102m during the same period, with a net loss of $102m as well. Free cash flow was a negative $129.5m during the 9 months of 2021. In 2021, Samsara spent 55% of revenue on marketing costs and 26% on R&D.

Gross margin increased from 60% in 2019 to 72% in 2021 mainly thanks to product improvements and economies of scale achieved as a result of revenue growth.

Cost of revenue consists primarily of the amortization of IoT device costs associated with subscription agreements, cellular-related costs, third-party cloud infrastructure expenses, customer support costs, warranty charges, and operational costs consisting of employee-related costs, including salaries, employee benefits and stock-based compensation, amortization of internal-use software development costs, expenses related to shipping and handling, packaging, fulfillment, warehousing, write-downs of excess and obsolete inventory, and allocated overhead costs.

During October 2021, the company reached an ARR of $493m, with 715 customers providing more than $100,000 in ARR.

Samsara was hit by COVID initially and had to lay off 300 employees.3 In connection with that, they recorded a $6.8 restructuring charge during Q2 FY2021 (year ending Jan 2021).

The company has grown steadily each quarter and narrowed its operating losses to -$32m. Cash used in operations was $123m in 9 months of 2021 and $138m in the prior year period.

Revenue growth rate has trended down from 166% in quarter ending May 2020, to 72% in October 2021.

If you like this analysis, please subscribe to my newsletter.

Management

Samsara was co-founded by Sanjit Biswas and John Bicket. Both co-founded Meraki, a networking company acquried by Cisco in 2012.

Sanjit holds a B.S. in Computer Systems Engineering from Stanford and an S.M. in Electrical Engineering and Computer Science from MIT.

John holds a B.S. in Computer Science from Cornell University and an S.M. in Computer Science from MIT.

Here is an interesting conversation with Sanjit Biswas about Samsara’s business:

Major Shareholders

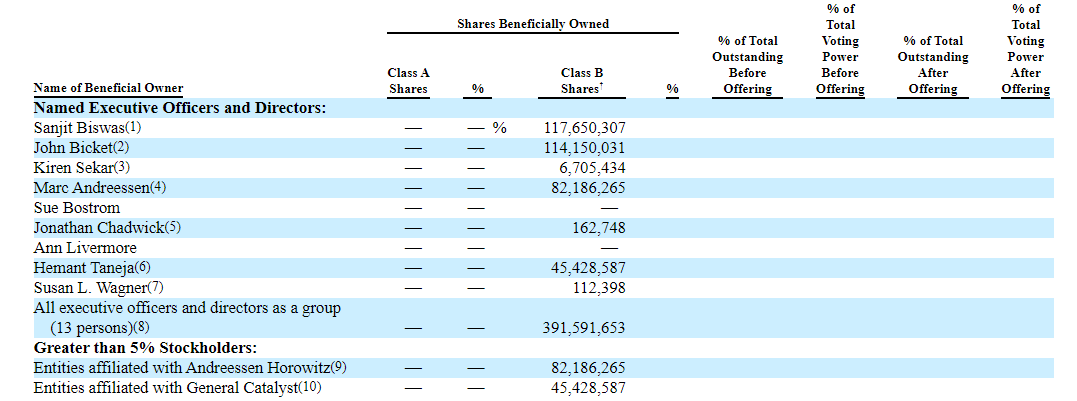

Largest shareholders of Samsara are its two co-founders, Sanjit Biswas (20% stake) and John Bicket (19% stake). Venture capital firms Andreesen Horowitz and General Catalyst hold stakes of 14% and 8% respectively.

According to their Series F, other investors include Tiger Global, Dragoneer Investment Group and Sands Capital.4

Addressable market

The company estimates that the size of their target market is $54.6 billion by the end of 2021, growing at a three-year overall compound annual growth rate of 21.0% to $96.9 billion by the end of 2024 (estimated by IDC, Gartner and Berg).

This opportunity consists of Samsara applications that include connected fleet ($32 billion), connected equipment ($2 billion) and connected sites ($20 billion)

Physical infrastructure represents 40% of the world’s GDP, and a lot of it still runs on legacy software platforms5.

Marketing strategy

The company employs its own sales force, targeting primarily large enterprises and medium sized businesses. Samsara offers a self-service model for small companies and projects.

In addition, the company works with integration partners and software resellers. Over 125 pre-built integrations are available on their App Marketplace. They also offer an open API, which is used by more than 6,000 customers, enables developers to integrate their applications into a variety of use cases from payroll to transportation management systems (TMS), fuel purchasing tools, navigation and more.

Competitors

In equipment monitoring, the company cites Orbcomm and ZTR as main competitors. In site visibility and surveillance, the primary competitor is Avigilon (a Motorola Solutions company).

Other upcoming competitors with promising technologies are Netradyne, Platform Science and Verkada.

Conclusion

Samsara was valued at $5.4 billion in its last funding round in 2020, which has likely increased since then. The exact date of their IPO is unknown at this point.

Source: S-1 filing https://www.sec.gov/Archives/edgar/data/1642896/000119312521334578/d261594ds1.htm

https://www.businessnewsdaily.com/16254-samsara-review.html

https://www.protocol.com/enterprise/samsara-ipo-industrial-iot

https://www.crunchbase.com/funding_round/samsara-2-series-f--f55d22ba

https://www.forbes.com/sites/karenwalker/2021/08/26/serving-the-under-served-samsaras-cpo-kiren-sekar-path-to-hyper-growth/?sh=4db6a4ac16c9