Vertex Pharmaceuticals: Monopoly position with exciting growth ahead

Promising pipeline will help drive sales growth in future years

Vertex Pharmaceuticals (VRTX) is a global biotech company that focuses on the treatment of cystic fibrosis (CF) with a strong development pipeline for other rare and common diseases.

Vertex has a dominant position in the cystic fibrosis market, with competing treatments years away from being approved

A “functional cure” for Type 1 diabetes is showing great promise in early trials, could potentially rival the size of cystic fibrosis market

Revolutionary CRISPR therapy for Beta thalassemia and Sickle cell disease is expected to be approved next year in US

Strong profitability, healthy balance sheet with an $8.4 billion net cash position

Vertex derives all of its revenue from treatments related to cystic fibrosis, a rare inherited disease that affects roughly 100,000 patients around the world. Vertex developed a major breakthrough in cystic fibrosis and currently sells four different medicines to treat the disease: TRIKAFTA/KAFTRIO (elexacaftor/tezacaftor/ivacaftor and ivacaftor), SYMDEKO/SYMKEVI,(tezacaftor/ivacaftor and ivacaftor), ORKAMBI (lumacaftor/ivacaftor) and KALYDECO (ivacaftor).

Vertex has invested substantial sums into R&D and managed to diversify into additional therapeutical segments such as Type 1 diabetes, kidney disease or Sickle cell disease and Beta Thalassemia. Several of these products are in phase 2 or 3 and will be marketed in the near future, if the trials prove to be successful.

The company has recorded strong growth in both revenues and profits, thanks to its newest drug on the market, Trikafta, which brought in $1.9 billion in revenue in the last quarter (Q2 2022), up 51% and representing 86% of sales.

It’s pretty clear that Trikafta is cannibalizing other products in the company’s portfolio, however there is still a significant portion of patients that either haven’t transferred to the new medication or are not undergoing treatment at this moment. Trikafta is a medication that is taken daily and is not a functional cure.

The company has a strong pipeline with treatments for several diseases in various stages of development:

Cystic fibrosis

CF is a rare (inherited) disease that causes sticky mucus to build up in the lungs and digestive system. This creates issues with digesting food and if the disease is not treated, it may lead to lung damage and difficulties with breathing. CF also causes clogs in the pancreas, which leads to problems with digestion. People suffering with CF often can’t absorb nutrients properly and need to eat more calories to avoid malnutrition.

CF is a very rare disease and it’s estimated that there are 100,000 patients suffering from this condition around the world. According to Vertex’s latest annual report, the company treats 83,000 patients in North America, Europe and Australia.

Vertex’s key product in this category is Trikafta, which generated 86% of product sales in Q2 2022. On the Q2 conference call, management stated that there are still 25,000 patients that could benefit from Trikafta and are not undergoing therapy at the moment. This suggests that there is still limited growth ahead for this product and the company should be able to increase sales further despite the saturated CF market.

Vertex has a strong patent portfolio, with the ones for Trikafta expiring in 2037, giving them a dominant position for years to come.

Acute Pain (VX-548)

Patients with pain can suffer from acute pain (for example, following surgery or an injury), neuropathic pain (when there is damage to a nerve), and musculoskeletal pain. Current treatments include opiods, that can have negative side effects and cause addiction. Vertex has developed a non-opioid solution, which has received a breakthrough therapy designation by FDA and has recently advanced to phase 3, with trials expected to begin in Q4 2022.1

Based on phase 2 trials, a high dose of VX-548 provided significant pain relief to patients with only mild or moderate side effects. According to analysts from SVB Securities, the target market for this treatment would be $500 million by 2030. Based on the recent Q2 Vertex presentation, the company estimates the addressable market of acute pain medications to be $4 billion.

Given the current opioid epidemic in United States, doctors are actively looking at alternative treatments, that would relieve patients of their pain without the negative side affects associated with opioids. Vertex’s product could be a game-changer in this area and if it proves successful, the target market could be multiples of the current estimates.

Sickle-cell disease and Beta thalassemia

Sickle cell disease (SCD) is an inherited condition that’s predominant in people with African or Carribean family background. SCD occurs due to a mutation in the beta-globin (HBB) gene. The HBB gene encodes for a key component of hemoglobin, the oxygen-carrying molecule in red blood cells. This mutation causes the production of abnormal hemoglobin, called sickle hemoglobin (HbS). Because of this abnormality, red blood cells become rigid and block small blood vessels, resulting in a lack of oxygen delivered to the tissues.

Patients with the disease suffer painful and severe episodes called sickle cell crises and have a higher risk of serious infections and a shortened lifespan. Treatment is typically focused on relieving pain and minimizing organ damage, requiring medication and, for some patients, monthly blood transfusions and frequent hospital visits. Vertex estimates, that there are 25,000 patients with severe SCD in US and Europe.

The only cure for SCD today is a stem cell transplant from a matched donor, but this option is only available to a small fraction of people living with SCD.

Beta thalassemia is an inherited blood disorder in which the body doesn't make as much beta globin as it should. Beta globin and alpha globin are building blocks of hemoglobin. Patients with transfusion-dependent beta thalassemia (TDT), the most severe form of the disease, require regular blood transfusions, as frequently as every two to four weeks. Repeated blood transfusions eventually cause an unhealthy buildup of iron in the patient, leading to organ damage. According to Vertex estimates, there are 7,000 patients with TDT in US and Europe.

Vertex’s product exa-cel, formerly known as CTX001™, is a CRISPR/Cas9 gene-edited therapy (one-time treatment) which aims to treat both SCD and TDT through editing a person’s hematopoietic stem cells to produce fetal hemoglobin (HbF; hemoglobin F). HbF is a form of the oxygen-carrying hemoglobin that is naturally present at birth, which then switches to the adult form of hemoglobin. The aim is to use the body’s own machinery to switch back to producing fetal hemoglobin.

After phase 2 trials, Vertex released results of 75 patients, almost all of whom are now living without the most serious effects of SCD. Vertex is expected to submit a biologics license application by March 2023 in US and by the end of this year in Europe.

Alpha-1 Antitrypsin deficiency

AATD is a rare, genetic disease characterized by a protein folding defect which can lead to liver and lung disease. The affected population is roughly 100,000 people2 in US, with only 10% of those diagnosed.

Vertex is just starting a phase 1 trial for the treatment after earlier setbacks3. It will likely be years before the medicine is introduced on the market.

Apol-1 mediated kidney disease

APOL1-mediated kidney disease (AMKD) is a kidney disorder associated with certain APOL1 genetic mutations. The disease can lead to kidney cell injury, cell death and damage to the glomeruli (which filter blood in the kidney). Approximately 1 in 5 people with 2 copies of the APOL1 gene variant will develop kidney disease, with African Americans having a 5 times higher likelihood of developing kidney disease than Americans of European descent. According to Vertex, c. 100,000 people in US and Europe have two APOL1 genetic mutations and proteinuric kidney disease.

Current therapies for AMKD do not treat the genetic cause of this disease and often don’t stop progression to kidney failure.

Vertex is developing a new therapy for AMKD, called VX-147, that treats the genetic cause of the disease by blocking the APOL1 function, which allows for the kidney to function properly.

In December 2021, Vertex shared the results of its VX-147 study showing that 48% of patients recorded a clinically meaningful mean reduction in protein in the urine, a sign of kidney damage. However, the study was relatively small and featured only 13 patients.

In June 2022, Vertex received a breakthrough therapy designation from FDA4 for VX-147. Breakthrough therapy designation will help expedite the review of Vertex’s treatment and ultimately its development and introduction on the market.

Type 1 diabetes

Type 1 diabetes (T1D) is a metabolic, autoimmune disease where the cells in the pancreas (pancreatic islets) that produce insulin are destroyed. Insulin is a hormone that the body needs to process glucose, a key source of energy. Without insulin, no cell in the body can use or store glucose normally.

Living with T1D requires lifelong treatment with insulin. People with T1D need to give themselves multiple injections of insulin per day or use an insulin pump that is attached to the body. They must also check their blood sugar levels frequently and manage their diet and exercise closely.

Vertex started developing its treatment VX-880 in 2021, and announced positive results from a study with 2 patients, showing a significant decrease in the necessary daily doses of insulin. Vertex expects VX-880 to be a “functional cure”, meaning that patients will no longer need to inject themselves with insulin, a truly breakthrough therapy.

In July 2022, Vertex snapped up its leading competitor ViaCyte to create the leading player in Type 1 diabetes treatment.5 Vertex is currently undergoing another study with 17 patients, which was briefly halted by the FDA, but is now in full swing. Type 1 diabetes affects millions of people around the world and Vertex reported that one of the patients enrolled in the study achieved full insulin independence after 9 months, a remarkable result.

The VX-880 accounts for the majority of Vertex’s estimated growth potential over the next several years.6

Duchenne muscular distrophy (DMD)

DMD is a genetic disease, primarily seen in boys, that affects the skeletal muscles, breathing muscles and heart. The treatment is currently in the research phase and hasn’t received an approval from a health authority yet.

Pricing

Vertex has a very promising pipeline targeting various rare and common diseases in an advanced stage of development. In most of the cases, Vertex’s treatment would be a “functional cure”, a truly game-changing result for patients. Vertex will likely aim for very high costs of these therapies, which will require the support of Medicare, Medicaid and other healthcare programs in countries around the world.

Vertex management

The company is led by Reshma Kewalramani, who started in Vertex in 2017 as a senior vice president of Late Development. Previously, she worked at Amgen from 2004 to 2017 as Vice president of Global Clinical Development. Based on the latest proxy statement, Reshma held c. 100k shares worth $30 million at current prices. She received a part of those thanks to her 2021 compensation, which totalled $15 million.

Insider ownership of the stock is less than 1% according to Gurufocus, while institutional ownership is c. 85%. There haven’t been any insider purchases over the past year.

The company has a 4.2/5 rating on Glassdoor, with an 88% CEO approval rating which is very good. For comparison, both Amgen and Regeneron have a 4.1/5 rating with a CEO rating close to 90%.

Competition

Vertex has a near monopoly in the cystic fibrosis market7 , and it is expected to hold this position for at least the next 5 years. Despite that, there are other players that are trying to get a piece of the market. AbbVie (ABBV) has indicated that it plans to develop a triple combination CFTR modulator therapy comprised of a potentiator and correctors. AbbVie has been conducting a dose-ranging study of a potentiator and corrector and a separate proof of concept study for a combination of their potentiator and correctors, and is expected to announce data in 2022.

Other smaller competitors who are developing CF medicines include Arcturus Therapeutics Holdings, Inc., ReCode Therapeutics, Inc., Krystal Biotech, Inc., Spirovant Sciences, Inc. and 4D Molecular Therapeutics, Inc.

Sickle cell disease and Beta thalassemia

Several companies, including deep-pocked players like Pfizer, Novartis and Novo Nordisk, are trying to develop new medicines for sickle cell disease and beta thalassemia. And just recently, Massachusetts-based Bluebird bio secured FDA approval of a gene therapy — another one-time, long-lasting treatment — for patients with severe beta thalassemia who require blood transfusions. Bluebird is developing a gene therapy for sickle cell, too.

Type 1 diabetes

Vertex acquired its major competitor ViaCyte, however, there are other global biotech companies that are developing various treatments for Type 1 diabetes. In addition, the current treatment with insulin is a well-established standard of care and Vertex will have to invest significant resources into convincing patients, doctors and regulators that their solution is safe and superior.

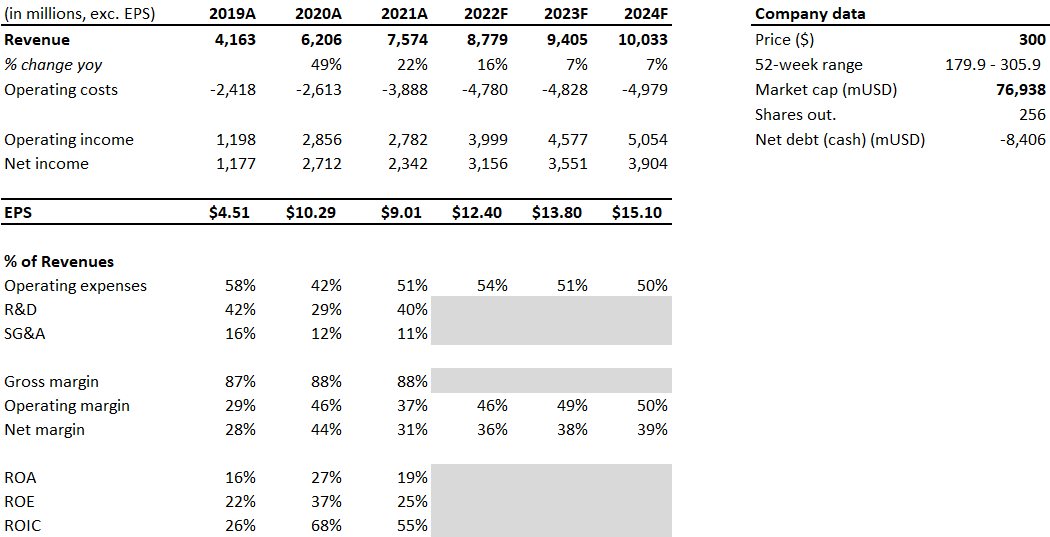

Valuation

The company is trading a forward P/E ratio of 22, when adjusting for their significant net cash position. Vertex generated $3.8 billion in free cash flow over the past 12 months, resulting in a an EV/FCF multiple of 18. This seems quite low for a company that has a near monopoly on the CF market with very stable cash flows and pricing power.

In addition, their pipeline is very promising with a leading position in acute pain treatment, type 1 diabetes “functional cure” as well as in Apol-1 mediated kidney disease. That’s probably the reason why it has significantly outperformed the S&P500 over the past year.

Summary

I believe in buying stocks with strong relative strength indications and VRTX definitely fits the bill. Their fundamentals are very sound, with significant room to grow if their clinical trials prove to be successful.

Vertex has a dominant position in cystic fibrosis, with competitors years away from developing other treatments. This will give them the necessary cash flow to invest in their pipeline and develop more life-changing medicines.

https://www.fiercebiotech.com/biotech/no-pain-only-gain-vertex-fda-greenlights-late-stage-trial-nonopioid-pain-drug

https://rarediseases.org/rare-diseases/alpha-1-antitrypsin-deficiency/

https://www.biopharmadive.com/news/vertex-alpha-1-antitrypsin-study-start-vx-634/633827/

https://www.biospace.com/article/fda-grants-breakthrough-designation-for-vertex-s-new-kidney-drug-/

https://www.nytimes.com/2022/08/09/health/diabetes-cure-type-1.html

https://www.fiercepharma.com/pharma/what-competition-vertex-touts-trikafta-s-competitive-edge-back-strong-2021

https://www.clinicaltrialsarena.com/comment/vertex-cystic-fibrosis-label-expansion/