Zhihu (ZH) IPO analysis: China's largest Q&A platform

The company is in an early stage of monetization with significant room to grow further and cement their dominant position

Zhihu is the no.1 platform for posting questions and answers in China’s internet space. The company was formed in 2010, almost two years after Quora and has since then grown to over 76 million monthly average users (33% yoy) and 315 million cumulative questions and answers and over 43 million cumulative content creators. Zhihu was recently included on BrandZ Top 100 Brands in China on 91st spot.1 Revenue grew 94% in 2020 and reached $207 million.

The company was founded by Zhou Yuan, a former reporter from Guizhou. His first software business failed2, however he continued pushing and eventually formed Zhihu. The site was invite-only for first 2 years, and started really monetizing its users in 2016. By being an “exclusive” site, it attracted a lot of high quality creators, who posted great content which in turn attracted more users and allowed them to beat their competition.

Users can register and ask questions, or they can answer questions posted by others. Similar to Quora, they get upvotes, shares or likes. Content can be posted in text form, audio, livestreams or videos (generally longer than one minute).

According to an analysis posted on Zhihu3, out of posts that received more than 1000 upvotes, only 19% were written by influencers with more than 200k followers, suggesting that there is a large distribution of quality content that is not concentrated in a few hands. In addition, the Zhihu highly upvoted (received for great answers) badge represents significant prestige in the Chinese online community.

Content creators get rewarded either through creating commercial or premium content, paid consulting or commissions from Recommended goodies (e-commerce feature).

The platform is widely used by various experts from a wide array of industries to write and post high-quality insights. You can get a lot of great answers on a diverse range of topics from career development to sports, politics or technology. In fact the site covers 1,000 verticals and 571,000 topics according to their F-1.

They went public in March, raising $523 million at $9.5, or the bottom of its IPO range.4 They raised an additional $250 million through private placements to Alibaba and JD.com affiliates. The company expects to use the proceeds for R&D purposes, marketing and potential acquisitions.

While the core still remains Q&A, Zhihu has expanded to several other areas over the years such as short videos, livestreaming and online education. The company uses artificial intelligence extensively to assess the quality of content posted by users (TopicRank), question routing to relevant users, feed recommendation and search functions.

According to their prospectus, 53% of users are based in Tier 1 cities, 43% are female and 79% are less than 30 years old. Zhihu has a very young and educated user base from largest cities, which is a valuable target group for advertisers. Daily active users open the Zhihu app up to 6 times per day.

The company generates revenue from 4 sources:

Advertising (62.4% of revenue; $129m): Advertising revenue was up 50% in 2020, despite growing only 23% during the first half of the year. Advertising is driven mainly by the number of MAUs and (average MAUs up 42% in 2020 to 68 million) and revenue per user, which was up 2.3% to 12.3 RMB. Performance (CPC) or display based ads can be placed either on Zhihu app or on their website.

Paid membership (23.7%; $49m): Called Yan Selection provides paying users access to a premium content library available exclusively on Zhihu. The average number of paying users went from 0.6 million to 2.4 million during 2020 (paying ratio went from 1.2% to 3.4%), and paid membership revenue increased by 160% in 2020.

Content-Commerce Solutions (10.1%; $21m): Posts and content published by companies, generating service fees for Zhihu. Increased by 135x due to their recent launch. Companies can either produce their own high-quality commercial content or they can invite existing and popular creators to produce content for them.

This seems to be a great monetization tool, due to higher click-through rates: “our content commerce-solutions have proven to be a highly effective marketing approach for merchants and brands, evidenced by an overall click-through rate multiple times higher than that of traditional advertising.”5 Zhihu is a great avenue for brands to build their reputation online, get closer to customers and explain the benefits of their products or services.6

Others (3.9%; $8m): Consists of commissions from sale of merchandise and third party online education courses. Content creators can place recommendations for products (on third-party e-commerce sites) and if a user purchases them, Zhihu gets a cut from that GMV and pays a part of it to creators. During 2020, the GMV of products sold through Zhihu reached 4.4b RMB ($672m).

Zhihu was initially slow to monetize its users, very similar to Quora. They are still relatively early on their monetization journey, advertising was introduced in 2016, paid content in 2018 and Yan Selection program in first half of 2020. Online education and e-commerce services were expanded significantly during 2020, hence the sharp increase in revenue. Zhihu has tried several monetization methods in the past, some of which were unsuccessful7, but eventually found their way and the company is on a clear growth trajectory.

Initially, users criticized the launch of advertising on the platform, citing lower quality answers and a lot of cluttered content. However, the company overcame these issues and Zhihu remains a thriving platform today.

Financials

Zhihu lost $79m during 2020 due to expenditures on marketing ($112.6m) and R&D ($50m), both of which actually declined compared to 2019. Zhihu acquires users mainly organically thanks to the rich content they have, but also through paid campaigns such as app installs, brand campaigns, celebrity marketing and TV ads.

The loss was smaller compared to 2019 thanks to a jump in revenues and improved gross margin (56% from 46.6%). The margins are still quite low given the nature of the business, the company must pay a significant chunk of revenue to its content creators as well as for acquiring new users. Content and operational costs (a part of cost of revenue) increased by 166% in 2020 to $31m, suggesting Zhihu has increased investments in content creators.

Zhihu had $475m in cash and short-term investments at the end of 2020 and no debt. The mezzanine equity was probably converted to common stock as is usual in IPOs, therefore they have more than $1.2b of liquidity available for further investments in their platform. I always like to focus on companies with little debt, it gives them plenty of options when times get tough. As the saying goes, it’s hard to go bankrupt if you don’t owe anything to anyone.

One drawback is their negative operating cash flow of $37.4m. I prefer to invest in companies that do not need any external capital and generate plenty of cash themselves. In this case they have a lot of cash on their balance sheet, but it’s always better to see positive cash flow, as it proves that their business model is valid.

Capital expenditures were only $300k during the year, as Zhihu spends money onR&D and marketing, which are expensed immediately and not capitalized.

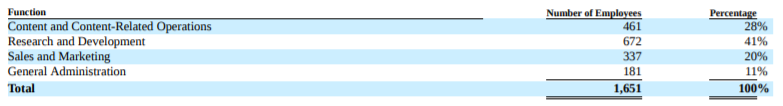

Zhihu had 1,651 employees at the end of 2020 and 41% of them were employed in research and development.

Market size and growth

The online community in China is massive, hitting 773 million in 2019 and expected to reach 1 trillion by 2025.8 The online content market reached 276 billion yuan ($42 billion) in 2019 and is expected to reach 1.3 trillion yuan ($198 billion). A large part of that are videos and video sharing sites, which take the lion’s share of revenue and Zhihu is currently a drop in the ocean with revenues of 1.4 billion yuan ($207 million).

According to a CIC survey, the number of users who pay for content at least once a year is expected to hit 588 million in 2025, a 17% CAGR from 2019.

China’s online advertising market is forecasted to hit 762 billion RMB ($116b) in 2020, out of which online content communities represent 21%. This is expected to increase to 28% (511b RMB) by 2025 at a CAGR of 26%.

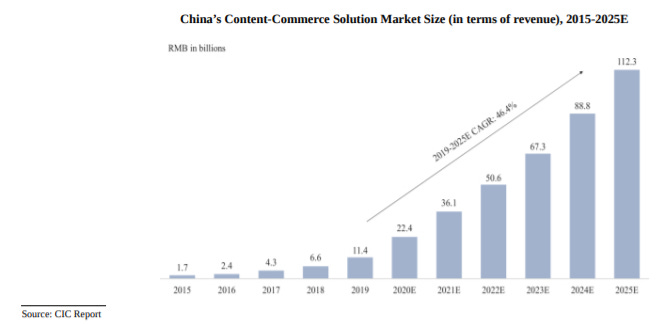

Similarly, the content commerce market is expected to quintuple, growing at a CAGR of 38% from 2020 levels.

Growth potential

Content is king, the primary way in which the company can grow in the future is to increase the number of users and the amount of content generated. This will in turn attract more users, creating a strong flywheel that feeds itself over time. Zhihu was long considered a platform for intellectuals in China, but in order to grow it must go more mainstream to attract a wider variety of users. It’s hard to say whether this will cause the quality of content to deteriorate, but it’s one risk to keep in mind.

According to an analysis from 20179 by CNNIC, 74% of Zhihu users had at least a bachelor’s degree, as a result the platform is perceived as having a lot of educated and young people on it. Zhihu is also popular with advertisers, as it helps build trust in your brand and also can improve your SEO, as Zhihu similarly to Quora is highly ranked by search engines.

Zhihu recently launched an online conferencing feature10, which seems to have been met with positive reception from users.

Currently they resell third-party online education courses, but plan offer their own in the future according to F-1: “For instance, through capitalizing on our deep pool of education content and knowledge-oriented user base, we intend to ramp up our online education service through effectively enhancing the penetration of education products among our current user base, and offering a diverse course portfolio that satisfies our users’ growing needs for educational content”.

Zhihu is very early on their monetization path and I believe they can grow revenues several times from current levels. Only 4% (at the end of 2020) of their user base are paying for subscriptions, ad revenue is growing by high double-digits and the content commerce monetization has just begun.

If the company can also attract a higher amount of users, becoming more mainstream the potential to grow further and achieve $1 billion in revenue is very real.

Competition

Zhihu has emerged as the top Q&A platform in the country, after beating Baidu’s Baidu Tieba and Zhidao, as well as Tianya, what used to be the largest Chinese forum. Bytedance also shutdown its similar site Wuking Wenda11. Kuaishou’s rivalry with Bytedance is one of the reasons why the company invested $434m in Zhihu along with Baidu.

Major Shareholders

Founder Zhou Yuan holds 7% of shares after the IPO, with 43% voting power. The largest shareholder (11.3%) remains Innovation Works, which is the venture fund of Kai-Fu Lee, the Chinese AI expert who was an early investor in Zhihu. Tencent is the second largest investor with a 11.1% stake. Kuaishou holds 7.1% through Cosmic Blue Investments.

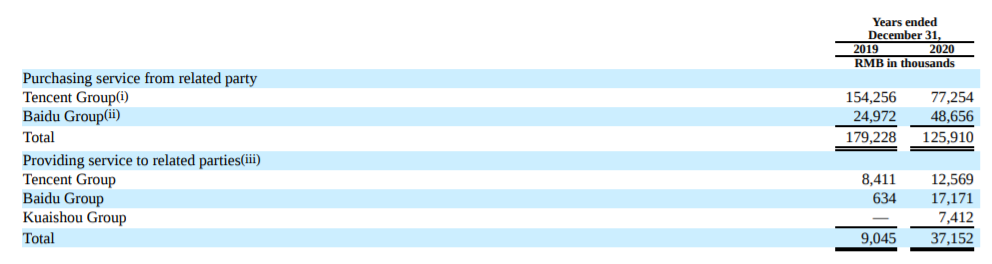

Even though Kuaishou, Tencent and Baidu own stakes in the company, the related transactions are mostly hosting fees and marketing fees paid to Tencent and Kuaishou and represent less than 7% of their total costs. Revenue from Tencent, Baidu and Kuaishou is insignificant at this point.

Valuation

Based on data from Yahoo Finance12, the company has 561 million shares outstanding, resulting in a market cap of $5.03 billion. If the preferred shares were converted and summing together the cash raised from IPO with their current cash balances, the resulting enterprise value is below $4 billion. This implies an LTM EV/Sales multiple of 20, and a forward EV/Sales of only 13 assuming revenues grow 45% this year.

Assuming a revenue CAGR of 40% for the next 5 years, the company would hit $1.2 billion in revenue by 2025. I believe their margins will improve significantly over the next few years, with gross margins heading toward 65-70% and with long-term free cash flow margins of at least 20% given the nature of the business.

If these assumptions turn out to be true, an investor is essentially paying 20x free cash flow a few years out for one of the most respected brands in China, with a dominant position, massive library of high quality content and plenty of monetization options.

I expect they will hit positive operating cash flow this year and will probably start generating free cash flow by the end of 2021. I am not buying the shares right now, but I will wait for their first quarter of positive operating cash flow and enter at the inflection point.

Risks

Competition: The primary risk comes from video platforms like Kuaishou, Douyin or Bilibili, which themselves have expanded into educational videos delivered by influencers with a large following. Short video is the dominant form of information consumption in China right now, whereas Zhihu relies mostly on text posts.

Delisting: US Congress recently passed a law requiring Chinese companies to open up their books for examination by PCAOB, the organization that oversees accounting practices of publicly listed companies in US. Failure to comply with this regulation would result in a delisting.

Ownership structure: As is common for Chinese ADRs, the holding company in which shareholders hold equity is merely a conduit and conducts business in China through various agreements with subsidiaries, without directly owning them. This poses a large risk in case management transfers assets between the subsidiaries or conducts fraudulent transactions.

COVID-19 impact

Their business has taken a hit from COVID during the first half of 2020, as many businesses in China paused their ad campaigns and Zhihu’s advertising revenue grew only 23% (to $45m) during the period. On the other hand, they likely beenfited from an increased number of monthly users, as people were forced to stay at home and spend time online.

COVID also delayed the launch of their content-commerce offering. The company decreased its marketing spend during the year, mainly due to the absence of offline events that they use to drive people to their platform.

https://www.chinainternetwatch.com/30833/brandz-top-brands/

https://www.caixinglobal.com/2021-03-08/qa-site-zhihu-to-test-us-ipo-market-after-crackdown-on-chinese-listings-101672576.html

https://zhuanlan.zhihu.com/p/71554231

https://finance.yahoo.com/news/chinas-zhihu-raises-523-mln-055456890.html

https://app.quotemedia.com/data/downloadFiling?webmasterId=101533&ref=115735895&type=PDF&formType=F-1%2FA&dateFiled=2021-03-19&cik=1835724&CK=1835724&symbol=1835724&companyName=

https://econsultancy.com/zhihu-china-s-q-a-social-platform-that-s-ripe-for-brands/

https://www.protocol.com/china/zhihu-ipo?rebelltitem=4#rebelltitem4

https://app.quotemedia.com/data/downloadFiling?webmasterId=101533&ref=115742413&type=PDF&formType=F-1%2FA&dateFiled=2021-03-23&cik=1835724&CK=1835724&symbol=1835724&companyName=

https://seoagencychina.com/zhihu-marketing-guide-done-by-chinese-experts/

https://zhuanlan.zhihu.com/p/342020014

https://www.caixinglobal.com/2021-03-08/qa-site-zhihu-to-test-us-ipo-market-after-crackdown-on-chinese-listings-101672576.html

https://finance.yahoo.com/quote/ZH/key-statistics?p=ZH